Berkshire Hathaway is looking outside the US to bolster the conglomerate. Find out more in this blog post.

On August 15th, the latest 13-F for Berkshire Hathaway revealed that Warren Buffett - who turns 90 today - had cut his stakes in most US banks (and fully sold out of Goldman). But while the Oracle of Omaha was dumping US banks, he was quietly building up sizable stakes in the five of the largest Japanese trading companies.

In a press release published late on Sunday, Berkshire Hathaway revealed that it had acquired stakes in Itochu, Marubeni, Mitsubishi Corp., Mitsui and Sumitomo of "slightly more" than 5%, signalling it may increase those holdings in the future. These holdings were acquired over a period of approximately twelve months through regular purchases on the Tokyo Stock Exchange. Based on Friday's closing prices for the trading houses, a 5% stake would be valued at roughly $6.25 billion.

According to the statement, Berkshire Hathaway’s intention is to hold its Japanese investments for the long-term: "Depending on price, Berkshire Hathaway may increase its holdings up to a maximum of 9.9% in any of the five investments”.

Following the report, shares in the trading houses jumped as much as 11% in early Tokyo trade, outperforming a 1.5% rise in the broader TOPIX share price index. Marubeni was the biggest gainer among the five, surging 12%. Sumitomo and Mitsubishi rose more than 10% and Mitsui rose 8.2%. Itochu - the only one of the four with a price-to-book ratio above 1 - rose 5.4% to a record high.

Shares of companies often rise when Berkshire discloses new investments, reflecting what investors view as Buffett's imprimatur.

It wasn't immediately clear what prompted Buffett to transition out of US banks and into Japanese traders at a time when the BOJ dominates most capital markets (and was last seen in possession of 80% of all local ETFs).

However, it is worth highlighting that the Japanese trading companies in many ways appear to be a typical Buffett investment: four of them trade well below book value, meaning their market capitalizations were below their assets.

Several also have hefty amounts of cash on hand. Mitsubishi, for instance, has seen steady growth in its free cash flow per share over the last four years, Refinitiv data showed.

Further and in a likely attraction for Buffett - who famously avoids investing in companies he claims not to understand - the Japanese trading houses are deeply involved in the real economy: steel, shipping, commodities, and in some cases retail.

Some analysts also mentioned that since Buffett's portfolio is becoming heavily skewed to Apple, he was perhaps looking for something complete the opposite of Apple.

The 5 Japanese Trading companies bought by Berkshire Hathaway are the following:

• Itochu (ticker: 8001 JP)

• Marubeni (8002 JP)

• Mitsubishi Corp (8058 JP).

• Mitsui (8031 JP)

• Sumitomo (8053 JP)

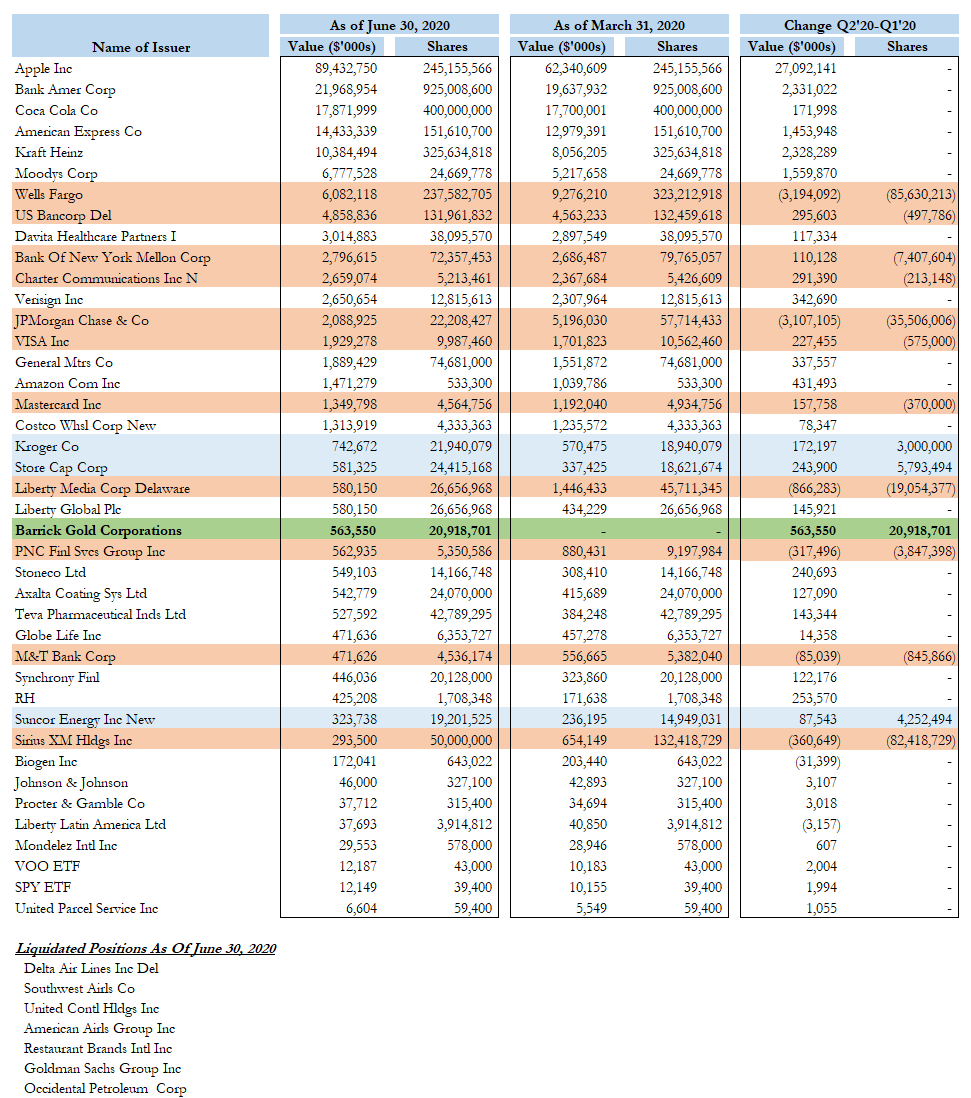

Berkshire Hathaway portfolio as of 30th of June 2020 (source: 13F report)