Feeling left out of the loop of the IPO buzz? The jargon, the hype, and the complexity can be overwhelming but you can fix that right now.

Gain complete clarity with our guide to what is an IPO, it breaks why companies choose to go public and list on a stock exchange, the pros and cons of doing so and lists famous past IPOs and potential future listings.

Stock Exchange in New York | Shutterstock

Need to Know

● An IPO marks the transition for a company from private to public, offering opportunities for capital growth but requiring transparency and market compliance.

● Historical IPO performances vary significantly, demonstrating the potential for both substantial success and notable failures.

● While upcoming IPOs attract investor attention, they also present risks and volatility inherent in IPO investments.

What is an IPO?

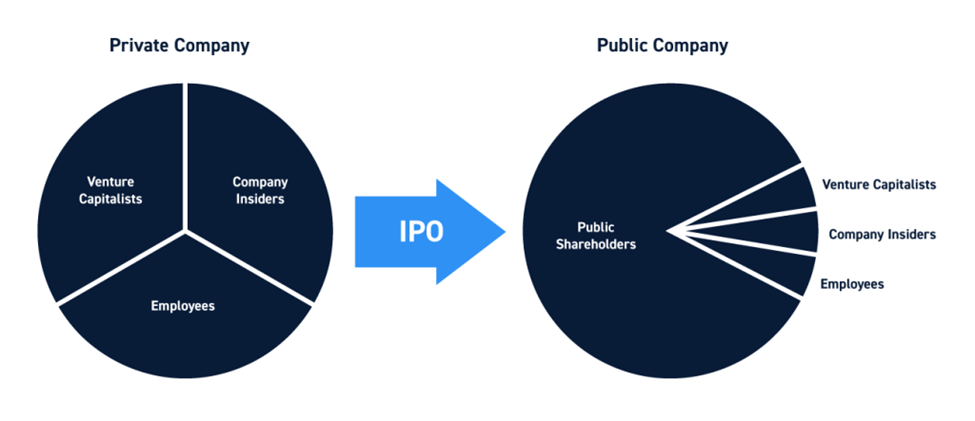

An initial public offering (IPO) is the process by which a business transforms from a private entity into a publicly traded company, whose shares are available for purchase by the general public on a stock exchange.

Almost any large publicly traded company you look at today, from Apple to Microsoft to Tesla and Nvidia started life as a private company. The other way public companies form is as a result of a merger or acquisition (M&A) but while this happens frequently, it occurs far less than a private company turning public, usually once it has reached sufficient size.

Source: Centerpoint Securities

In the context of legal business entities, private companies might be limited by shares (Ltd) or be private limited liability companies, depending on the jurisdiction. When these companies decide to go public, they transition into a public limited company (plc) or a corporation (Inc. or Corp.), accessible to any investor who wishes to purchase shares.

This transition is not merely a change in status; it involves a fundamental shift in how these entities operate, including adherence to the legal requirements set forth by securities regulators and exchanges. The IPO process democratizes ownership, allowing individuals and institutional investors to partake in the company's growth journey.

Why do companies IPO?

An IPO is a powerful vehicle for raising capital. By selling shares to the public, a company can access significant funds, which can be pivotal for scaling operations, funding research and development, or expanding into new markets.

Just as importantly, for the original investors and founders, an IPO represents an opportunity to realize the value of their investment, converting their equity stakes into liquid assets.

However, the benefits of going public extend beyond financial influx. An IPO enhances a company's visibility and credibility, establishing its presence in the global market. This elevated status can attract talented employees, foster strategic partnerships, and facilitate acquisitions. Public companies also gain a valuable currency in their shares, which can be used in mergers and acquisitions, providing a non-cash means to pursue growth opportunities.

IPO Initial | Shutterstock

What are the Alternatives to an IPO?

An IPO is not necessarily the right approach for every company and the owners and managers have other ways to reach their objectives, for example:

● Private Equity funds or investors provide capital in exchange for a significant stake in the company, enabling access to large amounts of money without public offering requirements.

● Venture Capital is especially suitable for early-stage, high-growth companies, venture capital offers investment in exchange for equity, supporting businesses with the potential for rapid expansion.

● Debt Financing is an way for companies to borrow money to fund their operations or growth initiatives, maintaining full ownership but incurring the obligation to repay the borrowed funds plus interest.

● Secondary Market Sale is another choice for founders and early investors can sell their shares through private transactions in secondary markets, providing liquidity without public offering.

● Mergers and Acquisitions are when a company is purchased by or merged with another entity, allowing founders and investors to exit their positions while potentially continuing to contribute to the business's growth under new ownership.

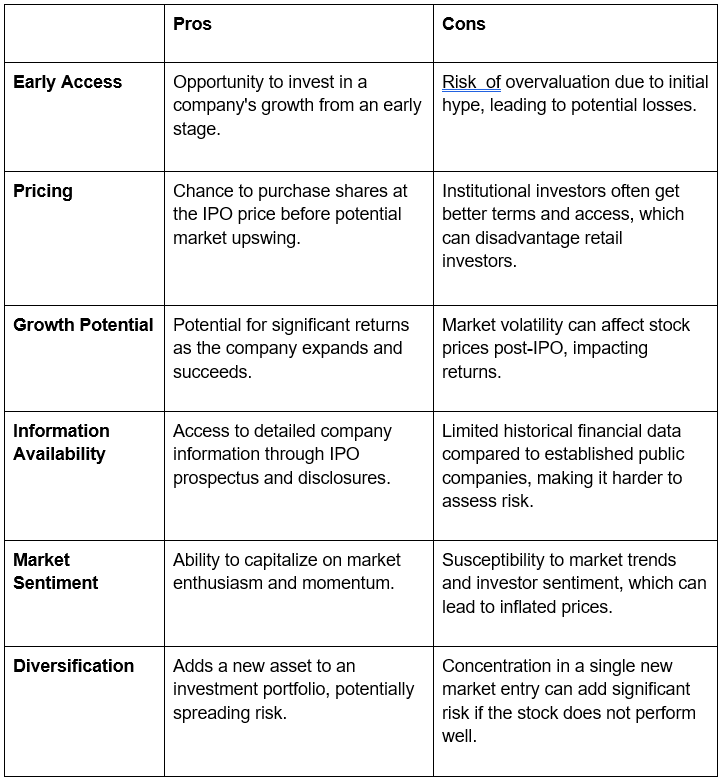

Is it Good to Invest in IPOs?

Investing in IPOs can be an exciting opportunity, but it comes with its own set of advantages and drawbacks that investors should consider:

Famous Past IPOs

The history of the stock market is dotted with the landmark public debuts of companies that have gone on to influence global economies and cultures.

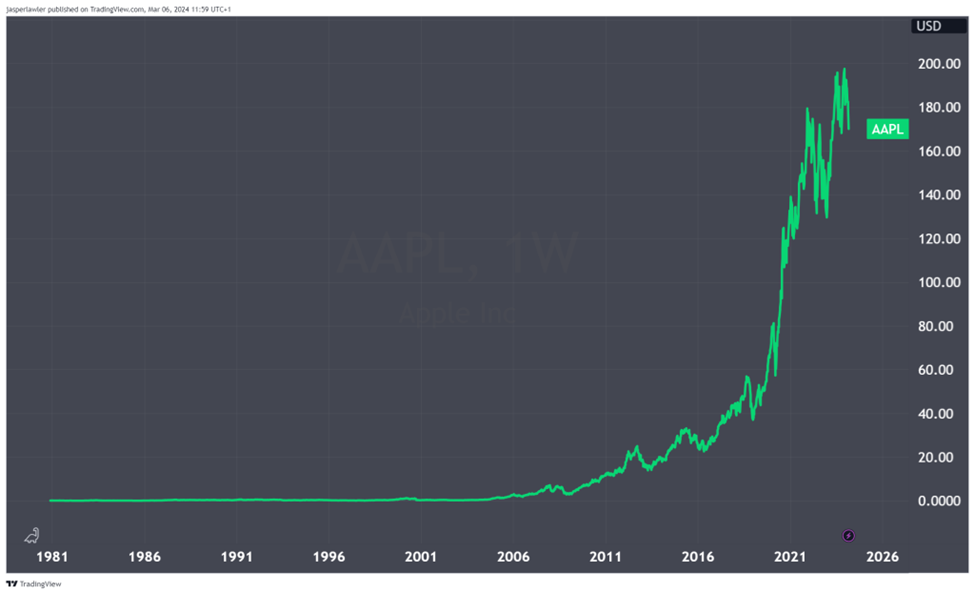

Apple Inc. (1980)

The Apple's IPO, similarly to the Micorsoft IPO showcased the immense potential of information technology companies, setting the stage for Apple leads the smartphone market, while Microsft dominates PCs.

Apple Shares (1980 IPO - March 2024)

Source: TradingView

Pets.com (2000)Pets.com's IPO came to symbolize the excesses of the dot-com bubble, with its high valuation not supported by fundamental business success, leading to its collapse and becoming a cautionary tale about market exuberance.

Facebook (2012)Initially plagued by a technical glitch on the Nasdaq that caused its shares to dip, Facebook's IPO faced skepticism. However, over time, the company's shares have rallied significantly, proving the enduring value in social media.

SPAC IPO Boom (2021)The surge in SPACs was one of the standout trends alongside meme stocks in the wak of the covid pandemic. They offer an alternative route to public markets with a little less fanfare than the traditional IPO. However, the aftermath has been sobering, with most SPACs from this period trading below their listing prices.

ARM Holdings (2023)ARM Holdings returned to the public markets after being taken private by SoftBank with its second listing, having first done so in 1998. Interest in the IPO has been strong with the firm likely to play a leading role in semiconductors designed for AI.

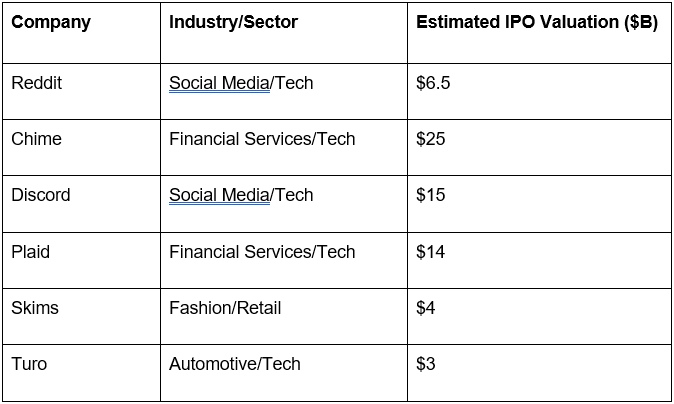

Exciting upcoming IPOs Source: Forbes In SummaryAn Initial Public Offering (IPO) is a key event where a private company becomes public, aiming to raise capital and expand its visibility. By examining past IPOs, one understands the spectrum of outcomes, from success stories to notable failures.The anticipation around upcoming IPOs highlights ongoing investor interest, yet it also emphasizes the need for careful analysis due to inherent risks like market volatility and overvaluation.

Source: Forbes In SummaryAn Initial Public Offering (IPO) is a key event where a private company becomes public, aiming to raise capital and expand its visibility. By examining past IPOs, one understands the spectrum of outcomes, from success stories to notable failures.The anticipation around upcoming IPOs highlights ongoing investor interest, yet it also emphasizes the need for careful analysis due to inherent risks like market volatility and overvaluation.

*The information contained on this page does not constitute a solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.