Curious about how the investment strategies of tech titan Elon Musk and legendary investor Warren Buffett differ, especially in the realm of Artificial Intelligence?

Warren Buffett notoriously turned down an investment in Tesla but has since gone big into tech via his Apple (AAPL) position. Now, both Musk and Buffett are using their own unique styles to invest in AI.

What's happening?

- Elon Musk took a jab at Warren Buffett, saying he should have invested in Tesla when it was worth 0.1% of its current ~$700 billion.

- Berkshire Hathaway, the investment conglomerate founded by Warren Buffett, just reported well-received third-quarter earnings.

- Musk’s AI startup xAI also just soft-launched its AI model Grok.

- Warren Buffett and cohort Charlie Munger are characteristically dismissive of the AI hype, but have made a few indirect investments in the biggest investment theme of 2023.

How Warren Buffet missed out on Tesla (but caught BYT)

Elon Musk recently commented jokingly on his social media platform X (Twitter) about a missed investment opportunity in Tesla, referencing its dramatic growth in value over the years. He was engaging with George Mack, who had shared an analysis based on a hypothetical question originally posed by Warren Buffett about investing in a person's future earnings.

In 2001, Warren Buffett gave a talk at the University of Georgia.

— George Mack (@george__mack) November 11, 2023

He asked them the most Warren Buffett question ever:

• If you could invest in a friend and get 10% of their income for life -- who would you pick?

Once the students answered the question, he then asked this:… pic.twitter.com/eGV0aQnmdx

Musk pointed out that Berkshire Hathaway, led by Buffett, could have potentially invested in Tesla when its value was significantly lower. A hypothetical $70 million investment for a 10% stake in Tesla, when it was valued at less than $700 million, could have escalated to an estimated $70 billion today, barring any share dilution.

Instead of investing in Tesla, Buffett's Berkshire Hathaway chose to invest $232 million in the Chinese electric vehicle manufacturer BYD in 2008. This investment significantly increased in value, reaching over $7 billion by early 2021, with Berkshire Hathaway realizing profits of over $1 billion from it.

Warren Buffett’s Top 10 Holdings

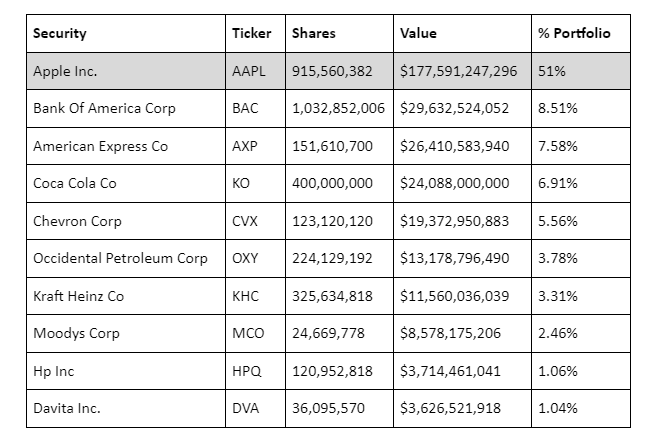

The top 10 securities held by Buffett’s Berkshire Hathaway:

Source: Insidermoneky.com

Who's right about AI investing?

Warren Buffett and Elon Musk represent two distinctly different investment philosophies, especially when it comes to emerging technologies like Artificial Intelligence (AI).

Warren Buffett's Approach to AI Investment

Buffett, known for his value investing strategy, tends to focus on companies with long track records of profitability and understandable business models. His investment decisions are grounded in the fundamentals of the business rather than speculative growth potential. This approach has historically made him cautious about investing in high-tech companies, including those focused on AI.

However, this doesn't mean Buffett avoids tech altogether. His major investment in Apple, while not an AI company per se, shows a recognition of the growing significance of technology in traditional businesses. Apple, with its ventures into AI through Siri and other machine learning applications, does reflect a mild but significant tilt in Buffett's portfolio towards tech-oriented companies.

Buffett's Berkshire Hathaway has also invested in Amazon, another company that leverages AI in many facets of its business, from logistics to Alexa. Yet, these investments seem more focused on the companies' solid business fundamentals rather than their AI potential.

Elon Musk's Approach to AI Investment

Elon Musk, in contrast, is known for his aggressive investment in cutting-edge technologies. His ventures, notably Tesla and SpaceX, are deeply integrated with AI for various functionalities like autonomous driving and spacecraft navigation.

Tesla, for instance, is at the forefront of AI in the automotive sector, with its significant investment in developing self-driving technology. SpaceX uses AI for predictive maintenance, autonomous decision-making during missions, and optimizing launch operations.

OpenAI, initially co-founded by Musk, is the biggest name in the AI landscape.

Public vs. Private AI Investment for Individual Investors

Buffett’s investments in companies like Apple and Amazon are through public markets, making his style more accessible to individual investors. They can easily follow his lead by investing in publicly traded companies that are incorporating AI into their business models.

Musk’s approach, on the other hand, often involves private investment in cutting-edge technology firms, which is less accessible for the average investor. However, his public ventures, like Tesla, offer a more accessible way for individuals to invest in AI, albeit in a more technology-focused and potentially riskier manner.

In Summary

Buffett’s cautious yet solid approach to investing in AI through well-established companies contrasts with Musk’s direct and high-stakes involvement in AI-centric ventures. For individual investors, understanding these distinct strategies can offer insights into different ways of approaching AI investments - either through stable companies in the public market

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who using it does so at their own risk.