You probably know some of the world’s biggest pharmaceuticals are Swiss, but who are they? how are they doing? - and why Switzerland?

The pharmaceutical sector in Switzerland contributes 5% to the country's GDP and makes up about 50% of its annual exports, surpassing the combined exports of Swiss chocolate, cheese, and watches. This dominance underscores the nation's innovative spirit, evidenced by the emergence of global pharma leaders like Novartis and Roche from Swiss roots.

In addition, many renowned pharmaceutical firms have substantial operations in Switzerland, employing a total of 47,010 people in 2020. The sector's prominence supports a growing life sciences market, sparking an influx of new start-ups. This thriving trend has positioned the pharmaceutical industry as Switzerland's primary growth driver.

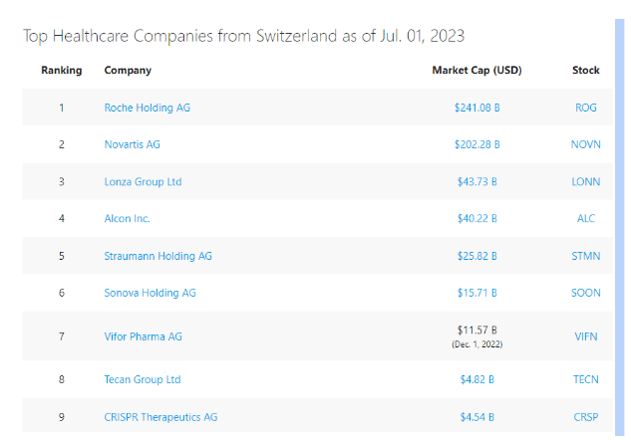

The Biggest Swiss Pharma Stocks

-

Novartis (SIX: NOVN) - A pharmaceutical giant that offers diverse products across cardiology, respiratory diseases, oncology, neuroscience, and generic drugs via its Sandoz division.

-

Roche (SIX: ROG) - Known for its oncology products and diagnostics, Roche is a dominant pharma player on the global stage. Roche's diagnostics offer state-of-the-art tools and tests.

-

Lonza (SIX: LONN) - Primarily serving the biotech sector, Lonza provides essential ingredients and solutions for other pharmaceutical companies.

-

Alcon (SIX: ALC) - Having spun off from Novartis, Alcon has carved a niche in the eye care product segment with a range of contact lenses and solutions.

-

Straumann Holding AG (SIX: STMN) - Specializes in dental implants, orthodontics, and dental tissue regeneration with a range of dental solutions with advancements in digital dentistry.

Also: CRISPR Therapeutics (NASDAQ: CRSP) - At the forefront of the gene-editing revolution, CRISPR Therapeutics leverages CRISPR/Cas9 technology to develop gene-based medicines.

Source: Disfold.com

Should I invest in Swiss pharma stocks?

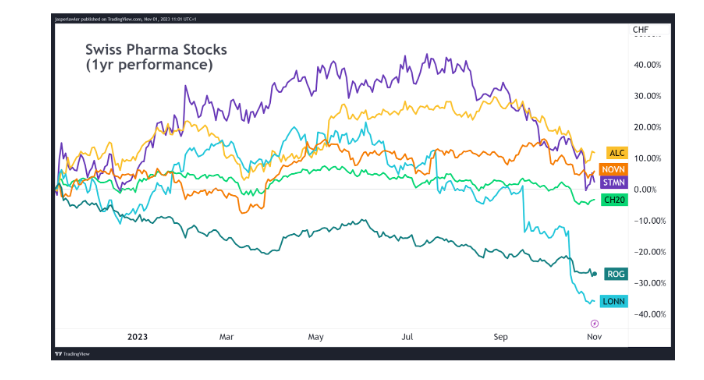

It’s been a mixed bag for Swiss pharmaceutical companies over the past year. ALC, NOVN and STMN have risen over the past year and have outperformed the broader Swiss market index (CH20). However, ROG and LONN have seen significant losses and underperformed the Swiss benchmark index.

This is a demonstration of the diversification in product lines and individual company performance within one country and industry.

More generally, large diversified pharmaceutical companies are often viewed as defensive investments, primarily due to the essential nature of their products. Medications produced by these giants cater to fundamental health needs and are not deemed luxuries, ensuring consistent demand regardless of economic shifts.

Furthermore, these large companies boast a broad product range spanning various medical conditions. This diversified portfolio acts as a buffer, spreading out risks associated with any single drug or therapeutic area. The predictable and long patent lifecycles further contribute to their stable cash flows and resilience in market downturns.

Conversely, biotech firms and smaller healthcare companies focused on R&D inherently possess higher risks. Often, their fortunes might hinge on a single product or a handful of R&D projects. This concentration can mean that an unsuccessful clinical trial or a regulatory setback can have pronounced effects on their valuation.

These smaller entities might also grapple with cash flow challenges, given their heavy R&D investments and unpredictable returns. Consequently, during periods when investors adopt a "risk-off" stance, these smaller, high-growth potential stocks might be more prone to underperforming, as they are perceived as riskier bets.

Why Switzerland?

Why have major pharmaceutical companies selected Switzerland as their preferred headquarters, and how has this choice contributed to their achievements? Although there will be many reasons for each individual company, we can identify three big reasons for such industry dominance.

1. Specialization in Pharma Excellence

Switzerland's export prowess, particularly in specialty chemicals, has made it a hub for pharma giants and SMEs. With an impressive 13% annual growth in pharma exports over two decades, the nation's commitment to R&D stands out. Milestones include Roche's breakthrough HIV treatments and Novartis' advancements in breast cancer care.

2. R&D Legacy

Basel's historical absence of patent laws positioned it as an R&D hotspot. Today, the city accounts for 90% of the nation's pharma value, with companies like Novartis and Roche spearheading research, backed by nearly CHF 16.8 billion annual investment in R&D.

3. Supportive Infrastructure

Switzerland's trade agreements with 43 countries, including giants like China and Japan, bolster its export capabilities. Recognized for high production standards and efficient regulatory procedures, it annually saves up to CHF 300 million in trade with key partners.

The Swiss pharmaceutical industry, while holding a formidable position in the global market, navigates a landscape filled with both opportunities and challenges. As countries in Asia and other regions invest heavily in their pharmaceutical sectors, Switzerland faces increasing competition in both production and R&D. Bigger picture, shifts towards personalized medicine, digital health, or alternative therapies could disrupt traditional pharmaceutical models. Switzerland needs to innovate continually to stay ahead.

In Summary

Switzerland serves as a linchpin in the global pharmaceutical industry, hosting giants like Novartis and Roche. With a deep-rooted legacy in R&D, strategic trade agreements, and specialization in chemicals, the nation has positioned itself as a global powerhouse in pharmaceuticals. But, it must remain agile and adaptive to the changing dynamics of the global healthcare industry to maintain its leading position.