The onset of 2024 has marked a resurgence in the value of the U.S. dollar against major global currencies, reversing its previous downward trajectory observed in December. This shift in currency dynamics can be attributed to favorable economic data emanating from the United States, which has cast doubt on whether the Federal Reserve is as inclined to reduce interest rates previously believed by the market.

The rise of the 10-year Treasury yield rate, surpassing the 4% threshold, has acted as a magnet, drawing flows towards the U.S. dollar. This has had a pronounced impact on the Japanese yen, which offers no yield and has suffered due to widening interest rate differentials.

Performance of Major Currencies So Far This Month: USD Leads, JPY Lags Behind

U.S. Dollar Update:

The U.S. dollar index climbed above 102 levels during early Tuesday trading, in anticipation of crucial inflation data scheduled for release on Thursday. Last week's data revealed that the U.S. economy added 216,000 jobs in December, surpassing the forecasted figure of 170,000. This unexpected resilience in the labor market amid tighter financial conditions has prompted investors to slightly reduce bets on Fed rate cuts in 2024. Money markets currently price in 140 basis point cuts in 2024, easing from the 160 basis points seen in late December.

Euro Update:

The EUR/USD pair traded around 1.0940 levels, retracting from its late December high of 1.1140. This retracement followed weaker-than-expected inflation data from Eurozone countries, which has fueled speculations about potential rate cuts by the European Central Bank (ECB) this year. Despite inflation in the Euro Area reaching 2.9% in December, primarily due to energy-related factors, it fell slightly short of the expected 3%. Market expectations now include the possibility of a 155 basis point reduction in ECB interest rates in 2024.

British Pound Update:

The British pound remained steady at the $1.27 mark, displaying relative resilience against the broader strengthening of the U.S. dollar when compared to other major currencies. The latest PMI survey indicated that the services sector in Britain exhibited stronger growth in December than initially estimated, with optimism reaching a seven-month high. As a result, markets are factoring in lower rate cuts from the Bank of England (BoE), with speculators indicating potential 120 basis point reduction in interest rates in 2024.

Swiss Franc Update: The Swiss franc has remained relatively stable, trading around the 0.85 per USD level since the start of the year, closely approaching its 12-year high of 0.83 achieved on December 29th. Recent economic data has shown that Switzerland's inflation rate in December surpassed expectations, registering at 1.7%, which aligns with the SNB's intended target and baseline predictions, but exceeds the consensus within the financial markets. In addition to its monetary policy initiatives, the SNB has actively influenced the Swiss franc's exchange rate through ongoing interventions in foreign exchange markets. The most recent data indicates that the SNB's foreign exchange reserves have reached their lowest point in over seven years.

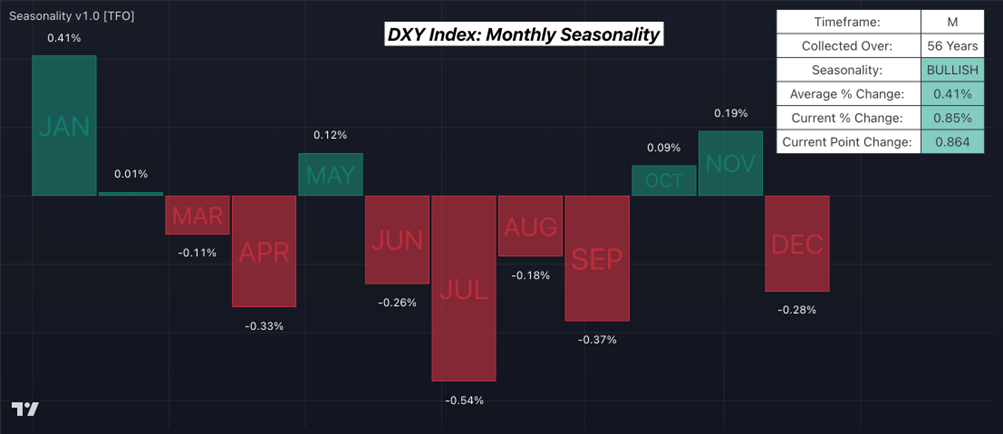

Chart of The Week: January Is The Best Month Of The Year For The USD

Economic Events You Cannot Miss This Week

United States:

- CPI inflation rate (Thu.): 3.2% year-on-year (y/y) expected, 3.1% y/y previous

- CPI core inflation rate (Thu.): 3.8 % y/y exp., 4% pre.

- PPI (Fri.): 0.1% m/m exp., 0% pre.

United Kingdom:

- BoE Bailey speech (Wed.)

- GDP - November (Fri.): 0.2% m/m exp., -0.3% m/m pre.

This Week's Forex Trading Ideas

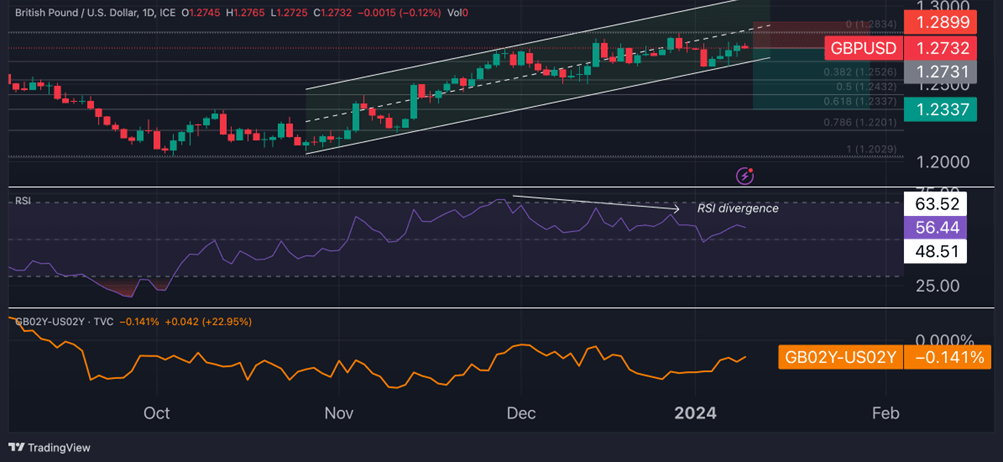

Short GBP/USD

- Entry: 1.2736

- Take profit: 1.2337

- Stop loss: 1.2900

- Reward/Risk: 2.4x

Fundamental Analysis of GBP/USD:

The Pound's underlying strength when compared to the US Dollar, as indicated by the 2-year yield differentials between British gilts and US Treasuries, currently remains broadly consistent with the average observed since mid-September. Consequently, the bullish momentum observed since late October seems to be influenced more by the broader global risk sentiment rather than changes in yield differentials. This suggests that a reevaluation of the Pound's value in relation to its fundamental factors could be on the horizon.

Technical Analysis of GBP/USD:

While the ‘cable’ has been trading within an ascending channel, a bearish RSI (Relative Strength Index) divergence formation emerged towards the end of December. From a technical perspective, this development could pose challenges for new bullish participants. If a retracement from the December highs to the October lows is underway, bearish traders might set their sights on the 61.8% Fibonacci retracement level, which stands at 1.2337 as a potential target.

Long CHF/JPY

- Entry: 169.38

- Take profit: 177.82

- Stop loss: 165.58

- Reward/Risk: 2.3x

Fundamental Analysis of CHF/JPY:

The Swiss franc has experienced a robust resurgence since mid-December, driven by several factors. Firstly, there has been an improvement in the interest rate differentials between Switzerland and Japan. Additionally, the Swiss National Bank (SNB) has maintained its ongoing efforts to sell foreign exchange reserves as a means to bolster the strength of the domestic currency.

Notably, the 10-year rate differential between Switzerland and Japan has once again expanded, now standing at 30 basis points. It is highly likely that this trend will continue, particularly in light of Switzerland's inflation rate surpassing expectations. This potential further widening of the rate differential could exert additional upward pressure on the Swiss franc against the Japanese yen.

Technical Analysis of CHF/JPY:

The near-term momentum for CHF/JPY has turned bullish again, showing improvement since mid-December. This is evident through the increasing RSI and the upward movement of the 21-day moving average recently. Nevertheless, there was a notable shift in sentiment last week when the pair reached a record high at 170.80, attracting some bearish activity. Still, the currency pair has potentially established a new support zone within the 166.40-166.90 range. This may act as a buffer against recent bearish pressures in the short term, helping to stabilize the market. Looking ahead, in the medium term, there is an opportunity for bullish investors to target an extension towards 177.82. This implies a substantial 5% increase from the current levels.

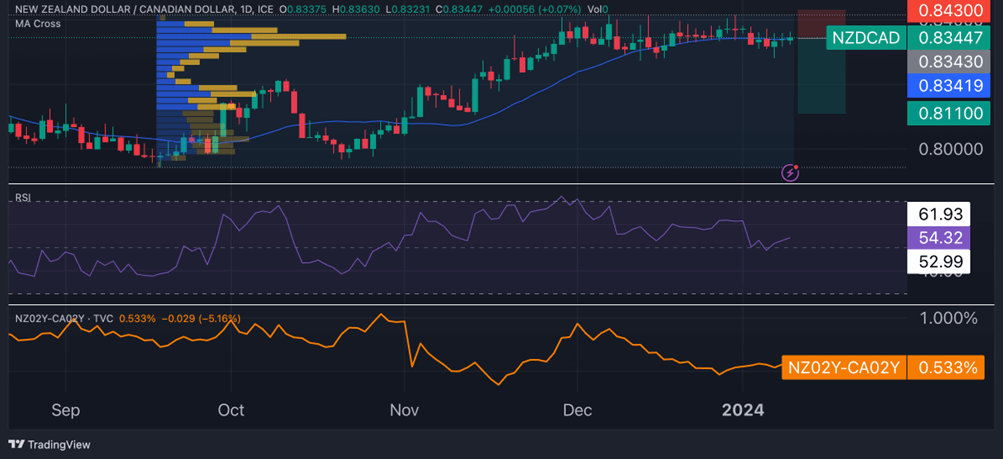

Short NZD/CAD

- Entry: 0.8343

- Take profit: 0.8110

- Stop loss: 0.8430

- Reward/Risk: 2.7x

Fundamental Analysis of NZD/CAD:

From early December, there has been a notable decline in the 2-year yield differentials between New Zealand and Canada, dropping from 1% to the current level of 0.53%. Surprisingly, despite this decline, the currency pair has maintained its position around the 4-month highs. This situation is raising cautionary flags for those anticipating further strength in the pair, as the relative carry advantage of the New Zealand Dollar (Kiwi) compared to the Canadian Dollar (Loonie) is diminishing. If oil prices have indeed reached their bottom and do not experience further declines, there may be underlying fundamental value in considering a short position on NZD/CAD at its current levels. This suggests that the Kiwi's relative strength against the Loonie may not be sustainable, potentially opening opportunities for traders to capitalize on this shift in market dynamics.

Technical Analysis of NZD/CAD:

A significant resistance area has come into focus within the 0.8370-0.8410 range. The NZD/CAD currency pair has made multiple attempts to breach this zone since early December, but it has consistently closed below it. Additionally, there are signs of diminishing bullish momentum as indicated by the declining trend in the RSI, as well as in the 21-day moving average’s flattening. There's a potential scenario where the pair retraces towards the 0.82 level, which was a prominent trading zone in early October. This retracement could serve as a means to tap into liquidity. Looking ahead, bearish traders may target 0.8110 as a compelling medium-term objective.

Open trading ideas:

- Short EUR/CAD

- Opened on December 19th at 1.4648

- Current: 1.4621

- Updated Profit & Loss: +0.2%

- Long AUD/JPY

- Opened on December 19th at 97.29

- Current: 96.48

- Updated Profit & Loss: -0.8%

- Long AUD/USD

- Opened on December 5th at 0.6577

- Current: 0.6700

- Updated Profit & Loss: +1.9%

- Short EUR/CHF

- Opened on November 21st at 0.9673

- Current: 0.9296

- Updated Profit & Loss: +3.9%

- Short USD/CHF

- Opened on November 21st at 0.8836

- Current: 0.8496

- Updated Profit & Loss: +3.8%

- Long AUD/NZD

- Opened on November 14th at 1.0856

- Current: 1.073

- Updated Profit & Loss: -1.1%

- Short NZD/CHF

- Opened on November 7th at 0.5327

- Current: 0.5305

- Updated Profit & Loss: +0.4%

- Long XAU/USD

- Opened on October 16th at $1,912/oz

- Current: $2,034/oz

- Updated Profit & Loss: +6.5%

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.