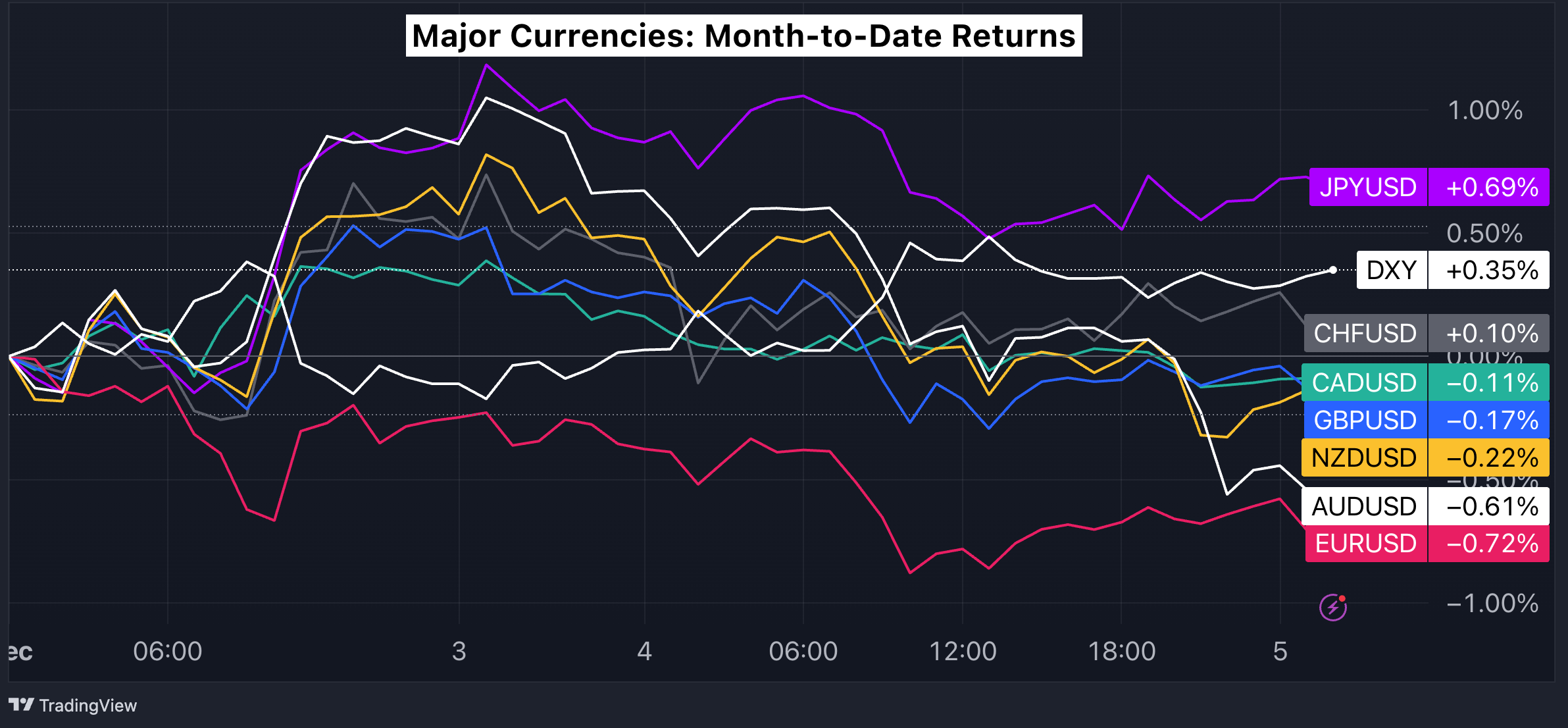

December started with the Japanese yen gaining ground against all major currencies as investors anticipate a pivot in the Bank of Japan's (BoJ) monetary policy in 2024.

Meanwhile, the dollar's descent has come to a halt after traders wonder if the Fed will really go so far as to cut rates as early as March 2024 and deliver 5 cuts now priced in for next year.

Month-to-Date Performance of Major Currencies: JPY Strongest, EUR Weakest

Forex Market: Week In Review & Week Ahead

US Dollar:

The U.S. Dollar Index (DXY) experienced a slight rebound after dipping to as low as 102.50 levels last week. This decline was driven by growing speculative bets on Fed rate cuts in 2024.

During a speech at Spelman College in Atlanta, Fed Chair Powell stated that it is still premature to assume that the Fed's tightening policy has concluded, emphasizing that further progress is necessary to bring inflation back to target levels. Initially, the markets dismissed Powell's warning, considering it a bluff, and increased their wagers on rate cuts in 2024.

This week, the primary focus is on the release of the November labor market report scheduled for this Friday. This report will provide crucial insights into the strength of the U.S. labor market.

Euro:

The euro (EUR/USD) experienced a slight retracement after breaking through the 1.10 level last week, reaching its highest point since mid-August. The most recent report indicates that the inflation rate in the Euro Area dropped to 2.4% in November, which is the lowest figure seen in over two years and below the market consensus of 2.7%. The lower-than-expected inflation data prompted traders to increase their bets on potential rate cuts by the European Central Bank in 2024. Nearly five rate cuts are now factored into the market's expectations by October 2024.

This week, the spotlight will be on October's retail sales data scheduled for release on Wednesday, along with the third estimate of the Q3 GDP data.

British pound:

After a 4% surge in November, the pound has held above 1.26 against the dollar for the past week, indicating the formation of a potential technical support.

Hawkish remarks kept pound bears at bay, as Governor Bailey emphasized the central bank's commitment to combat inflation and Deputy Governor Ramsden advocated a prolonged "restrictive" monetary approach.

Retail sales in November 2023 rose by 2.6% year-on-year, matching October's growth rate.

Japanese yen:

The Japanese yen has enjoyed a three-week winning streak, a feat not seen since March, and is currently at its highest level since mid-September. While concrete signs of an exit from the Bank of Japan's ultra-loose monetary policy remain elusive, traders are taking early action and anticipating potential changes. They have nearly fully priced in two 10 basis point hikes by October 2024.

Swiss franc:

The Swiss Franc (CHF) continued to strengthen, reaching its highest level against the dollar since late July.

There is a strong demand for safe-haven assets, with gold prices reaching a record high of $2,140/oz on Sunday, driven by Fed rate cut bets and the resumption of the conflict in Gaza between Israel and Hamas.

On the domestic front, economic data came in lower than expected. Annual inflation rate fell to 1.4% in November 2023, the lowest since October 2021 and below market expectations and October 2023’s 1.7%.

Key Economic Events For The Week

United States:

- ISM Services Index (Tue): 53.0 expected; 52.5 previous

- JOLTS Job Openings (Tue): 9.53 million expected; 9.55 million previous

- ADP Employment Change (Wed): 200k expected; 200k previous

- Initial Jobless Claims (Thu): 222k expected; 218k previous

- Change in Nonfarm Payrolls (Fri): 200k expected; 150k previous

- Average Hourly Earnings m/m (Fri): 0.3% expected; 0.3% previous

Eurozone:

- ECB Inflation Expectations Survey (Tue)

- Eurogroup Meeting (Wed)

- Retail Sales m/m (Wed): 0.4% expected; 0.40% previous

- GDP SA q/q (Thu): -0.1% expected

Others:

- Bank of Canada Rate Decision (Wed): 5.00% expected

New Trading Ideas For The Week

Long AUD/USD

- Entry: 0.6577

- Take profit: 0.6800

- Stop loss: 0.6490

- Reward/risk: 2.5:1

Fundamental view:

Traders reacted to the decision of the Reserve Bank of Australia to keep interest rates unchanged at 4.35% during the last meeting of the year, with Governor Michele Bullock stating that they are pursuing a data-dependent policy. The Aussie didn't respond positively, losing 0.7% in the post-meeting session. However, long-term rate spreads between local and U.S. 10-year Treasury bonds improved, reaching their highest level since mid-July. This level of fundamentals is comparable to an exchange rate range between 0.67 and 0.69, significantly higher than the current rate of 0.6575. A short-term opportunity could arise due to this 3.4% discount if the fundamentals remain stable or improve.

Technical view:

The AUD/USD pair appears to have initiated a new ascending channel pattern in late October, breaking above the resistance of the 50-day moving average. Additionally, the RSI is showing an ascending pattern, and the recent minor pullback from the level of 0.6690, reached on Monday, could present a more enticing opportunity for latecomer bulls. The target of 0.68 appears appealing, with a recommended stop loss set at 0.6490.

Short CHF/JPY

- Entry: 168.45

- Take profit: 162.50

- Stop loss: 170.70

- Reward/risk: 2.7:1

Fundamental view:

In mid-November, the Swiss Franc reached its all-time high at 170.50 against the Japanese Yen and is currently up by 19% since the beginning of the year. This rally appears excessive, especially considering the deteriorating relative fundamentals for the Swiss currency. The yield differential between Swiss and Japanese 10-year bonds has virtually disappeared, providing no "carry" for Swiss Franc bulls. The last time the spread was at par was in March 2022 when CHF/JPY was trading around 125.

Technical view:

The pair reached an overbought RSI level on November 15th and then transitioned into a range-bound trading pattern between 166.60 and 170. The declining RSI suggests a weakening bullish momentum. Notably, the 50-day moving average at 166.70 is currently an interesting level to monitor for the Swiss Franc's strength. If bearish forces manage to break below this level, their next target could be the 150-day moving average at 162.58.

Long XAG/USD

- Entry: 24.33

- Take profit: 26.94

- Stop loss: 23.31

- Reward/risk: 2.6:1

Fundamental view:

After rallying 25% from its October lows, silver started the week with a significant 4% decline. This movement could be driven more by profit-taking and low liquidity than substantial changes in fundamentals. Gold continues to trade well above $2,000/oz, long-term Treasuries (TLT) are benefiting from lower interest-rate expectations, and the U.S. dollar remains weak despite a recent slight uptick. The key test will be the U.S. labor market data: if Non-Farm Payrolls (NFP) come in below expectations, it could open up new bullish scenarios for silver.

Technical view:

The recent pullback appears to be a result of the extremely overbought RSI, as bulls take a breather following a 25% rally in just two months. The 2022 highs at 26.90 present an attractive medium-term target, to prove that silver entered a new bull market. From a technical perspective, the 200-day moving average at 23.45 serves as a support level to watch. A breakdown below this level, could indeed indicate a resurgence of dollar bulls and concerns about rising interest rates, potentially leading to further downward pressure on the price of silver.

Open trading ideas:

- Short EUR/JPY

- Opened on November 28th at 162.70

- Current Rate: 159.66832

- Updated Profit & Loss: +1.86%

- Long CAD/CHF

- Opened on November 28th at 0.6485

- Current Rate: 0.6471

- Updated Profit & Loss: -0.2%

- Long USD/ILS

- Opened on November 28th at 3.7063

- Current Rate: 3.7257

- Updated Profit & Loss: +0.5%

- Short EUR/CHF

- Opened on November 21st at 0.9673

- Current Rate: 0.9460

- Updated Profit & Loss: +2.19%

- Short USD/CHF

- Opened on November 21st at 0.8836

- Current Rate: 0.87

- Updated Profit & Loss: +1.5%

- Short CAD/JPY

- Opened on November 14th at 109.75

- Current Rate: 109.739

- Updated Profit & Loss: +0.0%

- Long EUR/GBP

- Opened on November 14th at 0.8718

- Current Rate: 0.8563

- Updated Profit & Loss: -1.77%

- Long AUD/NZD

- Opened on November 14th at 1.0856

- Current Rate: 1.0748

- Updated Profit & Loss: -1%

- Short NZD/CHF

- Opened on November 7th at 0.5327

- Current Rate: 0.5365

- Updated Profit & Loss: +0.7%

- Long XAU/USD

- Opened on October 16th at $1,912/oz

- Current Rate: $2,026/oz

- Updated Profit & Loss: +5.9%

- Short GBP/AUD

- Opened on September 18th at 1.9250

- Current Rate: 1.9093

- Updated Profit & Loss: -0.8%

- Short EUR/AUD

- Opened on September 4th at 1.6708

- Current Rate: 1.6549

- Updated Profit & Loss: +0.9%

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.