As the year 2023 comes to an end, major central banks have wrapped up their final meetings of the year, and a prevailing sentiment suggests that 2024 may see a wave of interest rate cuts.

Fed Chair Powell's tone struck a notably more dovish note than anticipated, with the Fed clearly signaling an openness to implementing a significant 75 basis points reduction, as evident from its dot plot. Nonetheless, market expectations are even more pronounced, with the consensus forecasting a reduction more than double the Fed's projection for 2024, with the expectation of rate cuts kicking off in March.

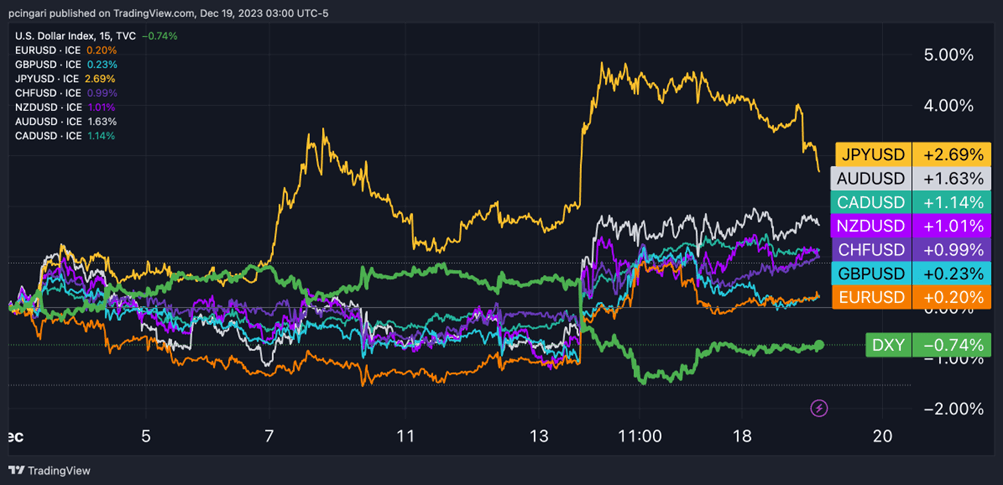

Month-to-Date Performance of Major Currencies: JPY Strongest, USD Weakest

US Dollar Update:

The U.S. dollar index saw a 1.4% decline last week, reacting to a relatively dovish Federal Open Market Committee (FOMC) meeting. The Fed's dot plot suggests rates may decrease to 4.6% in 2024, 3.6% in 2025, and 2.9%, with inflation gradually reaching the 2% target by 2025. Currently, the market anticipates a 150 basis point rate cut for the next year. In the days following the meeting, Fed officials like Williams, Mester, and Goolsbee tried to curb premature enthusiasm about interest rate cuts, helping stabilize the greenback's descent.

Euro Update:

On December 14th, the euro touched 1.10 against the dollar as the European Central Bank (ECB) struck a more hawkish tone than its U.S. counterpart. ECB Chair Christine Lagarde explicitly stated that rate cuts had not yet been a topic of discussion, providing unexpected support for the euro. Nevertheless, market sentiment remains uncertain regarding the ECB meeting's true implications, with investors factoring in a substantial 160 basis points of rate cuts in 2024. This reflects persistent economic challenges despite Lagarde's reassuring remarks.

British Pound Update:

The pound surged to 1.28 against the dollar last week, reaching its highest level since mid-August. This uptick was driven by a Bank of England (BoE) that adopted a more hawkish stance than anticipated, coupled with robust PMI and consumer confidence figures. BoE policymakers emphasized the need of maintaining a prolonged period of restrictive monetary policy as a means to tackle inflation effectively.

Japanese Yen Update:

In its final meeting of 2023, the Bank of Japan left markets disappointed by not providing any clear signals of a potential shift in its ultra-expansive monetary policy for 2024, despite prior expectations. The BoJ maintained its short-term rate at -0.1% and the target for 10-year government bond yields around 0%, with a 1% upper threshold. As a result, the yen experienced a 1% decline on Tuesday. Nevertheless, it's worth noting that the yen has still been the strongest currency for the month so far.

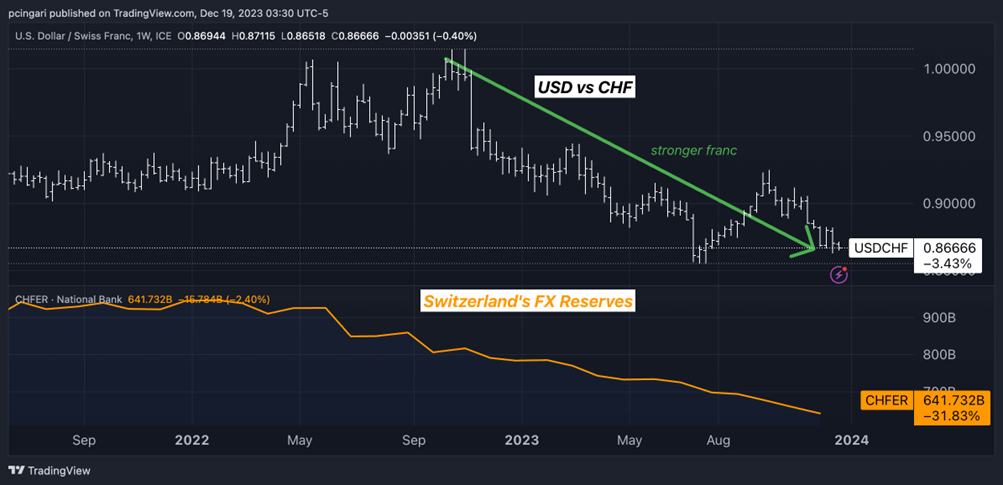

Swiss Franc Update:

The Swiss franc gained another 1% against the dollar last week, reaching levels not seen since late July. This increase occurred despite the absence of significant hawkish signals from the Swiss National Bank's meeting. The strength of the franc is primarily attributed to the central bank's reserve management strategy. The SNB continues to sell foreign exchange reserves to bolster the franc's value, aiming to mitigate the impact of surging commodity prices and avoid importing inflation from abroad. Swiss’ foreign exchange reserves fell to CHF 641 billion in November, the lowest level since January 2017.

Chart of The Week: Franc Strengthens As SNB's FX Reserves Decline

Economic Events You Cannot Miss This Week

United States:

- PCE inflation rate (Fri): 2.8% year-on-year (y/y) expected, 3% y/y previous

- PCE core inflation rate (Fri.): 3.3% y/y exp., 3.5% pre.

- Q3 GDP growth rate (final reading) (Thu.): 5.2% quarter-on-quarter annualized (2nd estimate)

Eurozone:

- Inflation rate (final reading) (Tue.): 2.4% y/y preliminary

- Core inflation rate (final reading) (Tue.): 3.6% y/y preliminary

- Germany’s Gfk consumer confidence for January (Wed.): -27 exp., -27.8 pre.

- Germany’s producer inflation: -7.5% y/y exp., -11% pre.

United Kingdom:

- Inflation rate (Wed.): 4.4% y/y exp., 4.6% y/y pre.

- Core inflation rate (Wed.): 5.6% y/y exp., 5.7% y/y pre.

- Retail sales (Fri.): -1.3% y/y exp., -2.7% y/y pre.

Others:

- Canada’s inflation rate (Tue.): 2.9% y/y exp., 3.1% y/y pre.

- Japan’s inflation rate (Thu.): 3.3% y/y pre.

- Japan’s core inflation rate (Thu.): 2.5% y/y exp., 2.9% y/y pre.

- BoJ monetary policy meeting minutes

This Week's Forex Trading Ideas

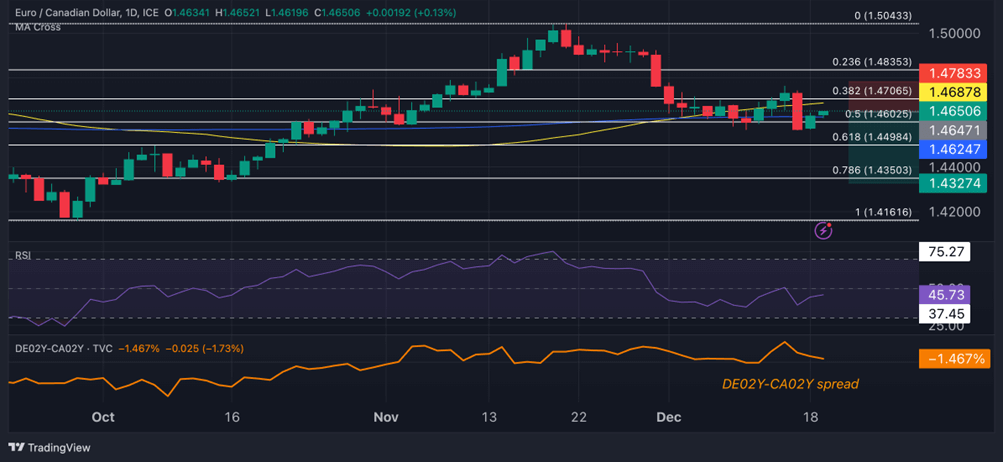

Short EUR/CAD

- Entry: 1.4648

- Take profit: 1.4327

- Stop loss: 1.4783

- Reward/Risk: 2.4x

EUR/CAD Fundamental analysis:

Even with a surprisingly hawkish ECB meeting, the market remained skeptical about eurozone rate cuts in 2024, viewing Frankfurt's statements as mere bluff. The 2-year yield spread between Germany and Canada stands at a negative 1.46% points, maintaining downward pressure on EUR/CAD. Furthermore, the recent resurgence in oil prices, if it persists in the upcoming weeks, could introduce an unexpected tailwind into the year-end dynamics for the Canadian dollar.

EUR/CAD Technical analysis:

EUR/CAD experienced a golden cross earlier this month as the 50-day moving average crossed above the 200-day moving average. However, this signal may prove to be misleading since the 50-day moving average will soon begin to factor in the pair's decline since mid-November. A Fibonacci retracement analysis of the range between October and November reveals that the pair has retraced more than half of its prior bullish move. Bearish traders might consider a near-term opportunity around 1.4327 (just below the 78.6% Fibonacci level), with a stop placed slightly above December's high at 1.4783.

Long AUD/JPY

- Entry: 97.29

- Take profit: 102.87

- Stop loss: 93.77

- Reward/Risk: 2.6x

AUD/JPY Fundamental analysis:

The Bank of Japan (BoJ) disappointed market expectations in its final meeting of the year by not signaling an imminent shift away from its ultra-loose monetary policy. This outcome represents a setback for yen bulls who had anticipated a more hawkish stance from the BoJ. The 10-year yield spread between Australia and Japan, which had dropped to 3.4% points on Friday, reaching its lowest level since September, rebounded following the BoJ meeting, providing renewed strength to the Australian dollar (Aussie).

The Australian dollar is gaining momentum in a potential double bullish scenario. First, China's economic recovery, supported by new stimulus measures, is expected to contribute positively. Additionally, the surge in global commodity prices, driven by a weaker dollar and trade disruptions, could further bolster the Aussie's performance.

AUD/JPY Technical analysis:

The AUD/JPY pair surged above the 50-day moving average in the wake of the BoJ meeting on Tuesday, marking its most significant one-day percentage gain since late July. The relative strength index (RSI) soared above the 50-point threshold, indicating a strong resurgence of bullish sentiment. This sharp bullish movement suggests the potential for further upside, with medium-term bulls setting their sights on the psychologically significant 100-point level, followed by the 2014 high at 102.91. To manage risk, placing a stop below this week's low could provide protection in case of an unexpected reversal by the BoJ.

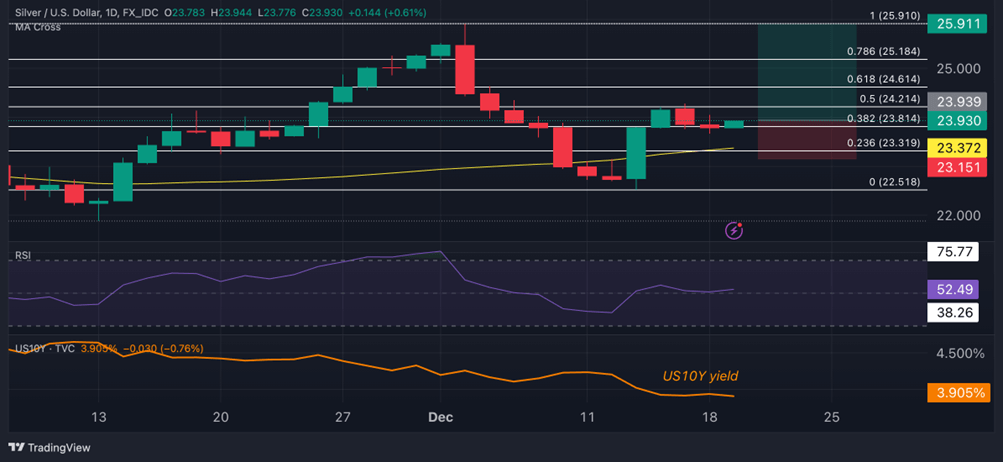

Long XAG/USD

- Entry: 23.92

- Take profit: 25.91

- Stop loss: 23.15

- Reward/Risk: 2.5x

Silver Fundamental analysis: Silver is currently trading at notably cheap levels compared to U.S. interest rate expectations and Treasury yield movements. The 10-year yield has dropped below 4%, reaching its lowest point since July 20, 2023. At these yield levels, silver was trading around the $25.3 range in July. If the Fed's preferred inflation gauge, PCE inflation data for November, confirms the expectation of further declines, the dollar could face additional downward pressure this week.

Silver Technical analysis: Following the Federal Reserve meeting on December 13th, XAG/USD experienced a robust 4.7% rally, marking its best single-day performance since mid-March. The precious metal has also climbed back above the 50-day moving average, potentially paving the way for further price increases in the coming weeks. Silver has retraced nearly half of the previous bearish wave that occurred between December 4th and 13th. Bullish traders may set their sights on a full retracement rally to $25.91. However, it's worth noting that a drop below $23.15 would be of technical significance, as it would breach both the 50-day moving average and the 23.6% Fibonacci retracement level.

Open trading ideas:

- Long AUD/USD

- Opened on December 5th at 0.6577

- Current: 0.6728

- Updated Profit & Loss: +2.2%

- Long CAD/CHF

- Opened on November 28th at 0.6485

- Current: 0.6477

- Updated Profit & Loss: -0.1%

- Short EUR/CHF

- Opened on November 21st at 0.9673

- Current: 0.9457

- Updated Profit & Loss: +2.2%

- Short USD/CHF

- Opened on November 21st at 0.8836

- Current: 0.8672

- Updated Profit & Loss: +1.9%

- Long AUD/NZD

- Opened on November 14th at 1.0856

- Current: 1.0789

- Updated Profit & Loss: -0.6%

- Short NZD/CHF

- Opened on November 7th at 0.5327

- Current: 0.5408

- Updated Profit & Loss: -1.5%

- Long XAU/USD

- Opened on October 16th at $1,912/oz

- Current: $2,025/oz

- Updated Profit & Loss: +6.1%

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.