Investing in Roblox stock will be possible on March 10, the RBLX IPO date. But does being a successful gaming company mean it will be a good nvestment?

The online gaming company behind Roblox has filed for its first debut on the stock market and there is already huge buzz. If my son was old enough to invest, this would 100% be in his portfolio!

When is the Roblox IPO?

The Roblox IPO is on March 10 and will trade using the RBLX ticker via a direct listing on the New York Stock Exchange.

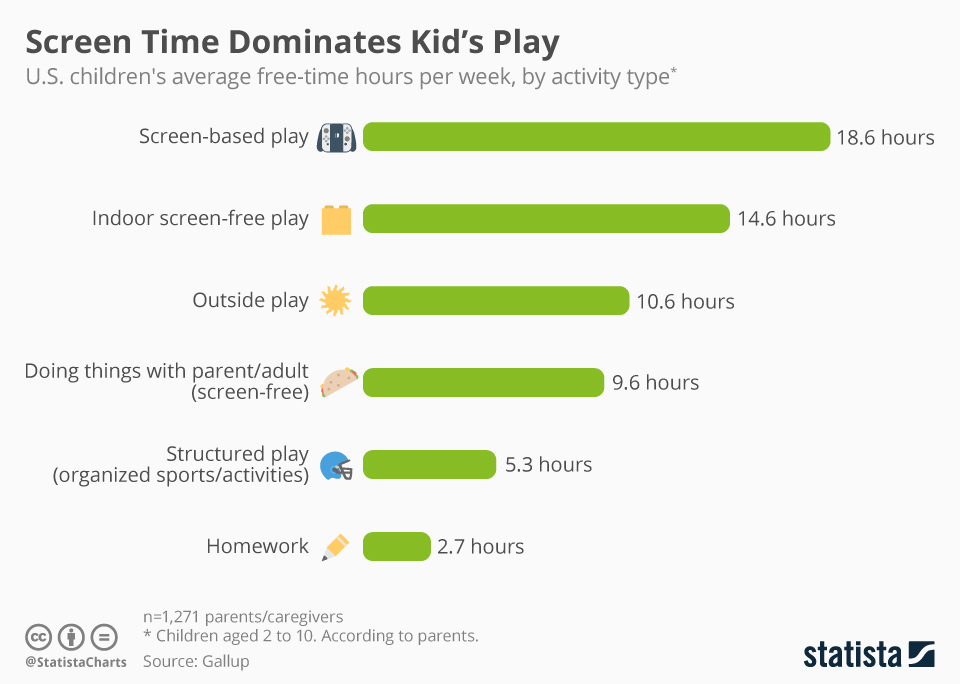

This is astute timing for the company since both tech stocks and kids ‘screen time’ (playing things like Roblox) are both at record highs!

But would investing in the IPO be good timing for us as investors?

The Roblox stock price

The company behind the Roblox imagination platform has not officially been priced but based on the last funding round, which valued it at $29.5 billion, judging the entire share capital, the shares could open trading at around $45 each.

This is a substantia;l jump in valuation from when the first Roblox IPO was attempted and then abandoned in December amid a flurry of online company stockl listings. If we use monthly active users as a guide - Roblox had 115 million MAUs in February - as of July that was 164 million MAUs - then Roblox should be valued at over $5 billion.

In addition, Roblox announced some updated statistics in July that is helpful for determining value. The 'economy' section of the PR update from Roblox reads as follows

“Developers are on pace to earn $250 million in 2020, up from the $110 million earned in 2019. In addition to earning through the sale of in-game products, developers are now also able to monetize their games through engagement. Earlier this spring Roblox introduced Premium Payouts which pays developers based on the engagement time of Premium subscribers in game. In June 2020, Roblox developers earned $2 million as part of this program alone.”

This $250 million is essentially the company’s revenue- so that’s annual growth of 127% - not too shabby. What is Roblox? (parents skip to next section!)

The game of Roblox is older than most of its players! CEO David Baszucki and Vice President Erik Cassel founded Roblox in 2004 and launched the platform in 2006. The core group of Roblox players are 9-12yrs old.

Roblox is an online game that over the years has transitioned into a game-creation hub where gamers can play games made by other users. It started out on the PC and moved to mobile in 2012 and is now truly multiplatform - available on Xbox and PlayStation too.

Still no idea what we’re talking about? Here it from Roblox themselves here-

Roblox encourages game development through its own interface and the developers earn money (see below). My boy attends a Roblox programming club!

The game is most popular among 7 to 15-year olds. According to The Verge, over half of American children play the game regularly- which is quite stunning!

How does Roblox make money?

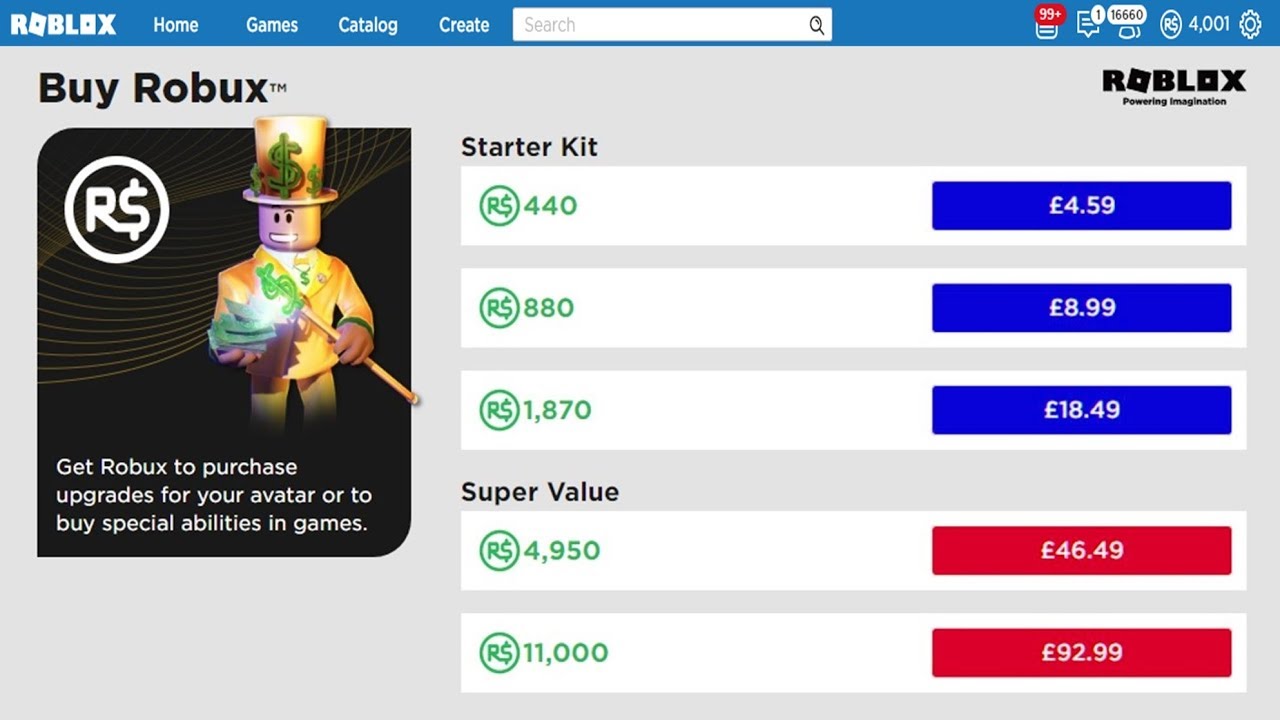

The short answer is from your iTunes account! The game is free to download so the money is made with in-app purchases. A parent must exchange their hard earned currency for 'Robux' (Roblox-bucks.. clever!).

Roblox doesn’t directly pay developers to create games - rather the developers make money by said virtual payments. The 'Robux' that are handed over for buying accessories to your child's avatar or for special items or to skip a level is split between Roblox and the developer. The precise cut these developers receive from the company is not public information - though it could well become so in the IPO prospectus.

Members of the Roblox Builders club can upgrade to Classic, Turbo and Outrageous membership categories with monthly subscriptions running from $5.95 to $129.95. These memberships receive benefits of certain amounts of Robux and are necessary to share content on the platform.

How to buy Roblox stock

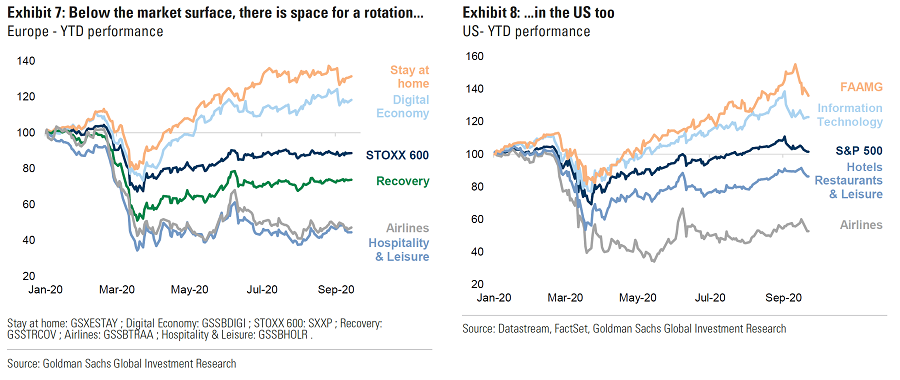

Time spent on mobile devices and computer games has gone through the roof with school closures during the coronavirus lockdown. The earnings power of companies related to the video game industry worldwide - including the likes of Tencent in China - and Epic games, the US maker of the popular game Fortnight - has increased immeasurably because of the pandemic.

Only time will tell how much of the new demand for video gaming this year has staying power - this in a sentence is the primary risk in getting involved in this IPO.

Roblox management have likely watched with interest the recent IPO of Unity Technologies - a rival gaming platform that reports to have been used in the creation of 53% of the top 1000 most popular mobile games.

The stock has moved up a healthy 30% since its IPO despite choppy broader markets and concerns of excess valuations in tech stocks.

Is buying Roblox stock risky?

Stay home stocks trend

We alluded to the first risk already. 2020 has been a statistical aberration on almost every level because of the pandemic. GDP and unemployment figures are off the chart- as is the money printed and spent by governments. The same probably goes for gaming. The long-term growth of the industry looks rock solid but a mean-correction seems probable.

On a personal level, are you utterly sick of Netflix and watching sport happening in empty stadiums on TV? There are actions and reactions and a sudden desire to be outside and off screens could be a 2021 phenomenon that hits the ‘stay home’ stocks as a category which we think Roblox would fit within.

Are software IPOs a good investment?

The track record of software stocks is sketchy. Zynga (ZNGA) IPO’d at $10 per share in 2011, its now $9... King Digital Entertainment - the maker of Candy Crush came to market at $22.50 and was sold two years later to Activision Blizzard (ATVI) for $18. This year though, Activision has done very well.

Is Roblox profitable?

The idea of having a platform for users to create games is almost the social media model of gaming - it’s genius. The idea is to create a development-friendly platform and let the users create the content, which is always being updated. It keeps the experience fresh so that users stick around and play for longer. It also means Roblox doesn’t necessarily need to always be on the search for the next best top-selling title- with online updates and user-generated content - they can focus their attention on their core product.

The social and user-development aspect of Roblox has helped its endurance for the past 14 years. BUT kids are fickle little beasts! It is almost inevitable that the next best thing comes along and displaces Roblox in their hearts someday.

Summary

Roblox is a hugely popular video game with a proven ability to earn money and an impressive 12-month growth rate in revenues. It perfectly rides the stay home trend that performed best in stock markets during the COVID-19 pandemic of 2020. Other stay home stocks like ZOOM and the FAAMG names are so overvalued, Roblox could provide a welcome new opportunity. The open question is whether stay home has run its course and if Roblox as a game has staying power with so much competition.

Thanks for reading and happy investing!

Sources:

https://investmentu.com/roblox-ipo-stock/https://investorplace.com/2020/10/roblox-ipo-looking-to-play-the-ipo-game/https://markets.businessinsider.com/news/stocks/roblox-public-offering-video-game-platform-ipo-direct-listing-filing-2020-10-1029671211https://www.valuethemarkets.com/2020/10/22/upcoming-tech-ipos-2020-yet-another-surprise-entry-as-roblox-takes-the-stagehttps://news.crunchbase.com/news/its-game-on-for-roblox-as-popular-platform-preps-for-ipo/https://www.pocketgamer.biz/the-iap-inspector/67520/how-does-roblox-monetise/