Thanks to Disney+, some analysts now view The Walt Disney Company as a solid buy and hold stock. This is a recap of the streaming mission that saved Disney this year.

New content, and a lot of it

Disney recently announced they were preparing over 100 new pieces of content linked to your favourite franchises. They claim to focus on quality rather than quantity. Out of these 100 new projects, 80% will directly be available on Disney+.

Instead of producing movies and series, Disney chose to make a combination of the two, with long movies separated into smaller episodes. You can consume lengthy content and still have your snacks and bathroom breaks, according to the Snack’s Daily Podcast.

They are aiming to release one a week. That is a lot. In their projects, they have no less than 10 Marvel releases, 10 Star Wars releases and 15 Pixar productions. This way, you will be able to watch the prequel of the sequel of your favourite universe, as well as the postquels of the prequels of this trilogy you love. One thing is for sure, you will know everything that you need to know about your favourite universe, whichever it is.

From a media company to a tech company

Disney used to be a media company, but today, it is increasingly positioning as a tech company, a sector that gets a much higher multiple on Wall Street. In order to see this, we only have to compare its stock price to what the company makes. Usually, media companies trade on a P/E ratio between 10x and 20x, but Disney is trading at 60x, which indicates that Wall Street is awaiting increasing returns. With such a multiple, it is on par with the bigger streaming services such as Netflix.

Therefore, it seems that Wall Street expects to see the returns of a tech company: low at first and high afterwards. Long gone are the days where Disney had to count on its theme parks to generate a cashflow. The company is now largely seen through its most promising branch, which is streaming. This partly explains why we're seeing their stock at a record high.

Growth, 10 times faster than Netflix

Their growth is tremendous. As of today, Disney+ has 86 million subscribers. If we add other Disney-owned streaming services (that is, ESPN and Hulu), we reach the incredible number of 137 million subscription. As a benchmark we can take Netflix, which has 73 million subscribers in the US, and 195 million subscribers worldwide.

This means that Disney+ has 2/3 as much as Netflix. However, one thing is very different. Disney+ launched its service a little more than a year ago. Netflix has been working on it since 2007. Quite an impressive growth to achieve 60% within a tenth of the time.

Briefly touching on the segment growth, Benjamin Swinburn, a Morgan Stanley analyst argues that direct-to-consumer business will be Disney's core by 2024. He goes even further by saying that their customer base might surpass that of Netflix by this time, or earlier even.

Disney expects its combined customer base to reach 350 million. The company expects to reach a peak loss in 2021 and become profitable by 2024 fiscal year, up from their 137 million today. As a comparison, Netflix estimates finishing the year with 200 million.

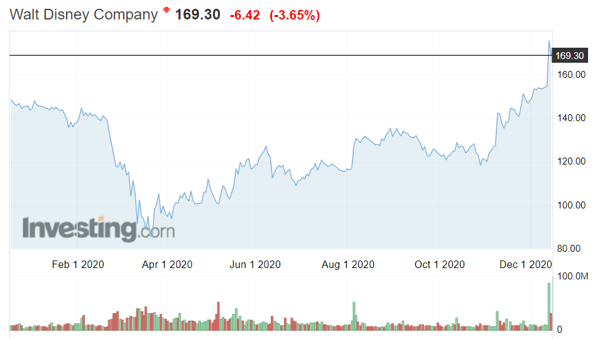

About the stock

Although Friday saw a sharp raise with +14% before settling down a little. Analysts at the Motley Fool suggest that it might not be too late to get on the stock, considering the extremely high expected growth of the company's streaming services.

After all, what you have here is one of the most resilient streaming businesses, backed by the creative team who produced the timeless classics of our childhood as well as some of the most beloved franchises on the planet. For all of these reasons, they suggest that it might be a solid stock to hold on to.

Walt Disney Company stock (Source: Investing.com)

A word from the CEO to conclude

Ben Chapek, Disney's CEO, said: "Despite the many challenges and hardships, I’m proud to say we have been steadfast in effectively managing our businesses under enormously difficult circumstances. We haven’t just persevered during these tough times, we’ve also taken a number of deliberate steps and smart risks that have positioned our Company for greater long-term growth.”

He added: “And the impressive resilience Disney has demonstrated while looking past today’s challenges to set the stage for an even brighter future, is a direct reflection of our outstanding team.”

Sources:

Should You Buy Disney Stock As Its Streaming Business Ramps Up?, in the Motley Fool

Netflix subscribers count worldwide 2011-2020, in Statista

“The (New) Roaring 2020s” — Disney’s Shmovies. Restoration Hardware’s Gatsby earnings. Pfizer’s vaccine payday, in Snacks Daily Podcast

Disney unloads a slew of impressive Disney+ announcements, announces price hike, in CNBC

Disney’s stock rises after monumental Investor Day announcements, in Fox Business