The Swiss Franc (CHF) wrapped up 2023 with an impressive performance in the global foreign exchange market, leaving investors and traders investors and traders curious to know if the CHF can sustain its impressive run in the new year.

As we delve into 2024, it's essential to reflect on the factors driving the CHF's strength, its policy and economic outlook, and the technical analysis of the USD/CHF pair.

Recapping 2023: A Year of Franc Dominance

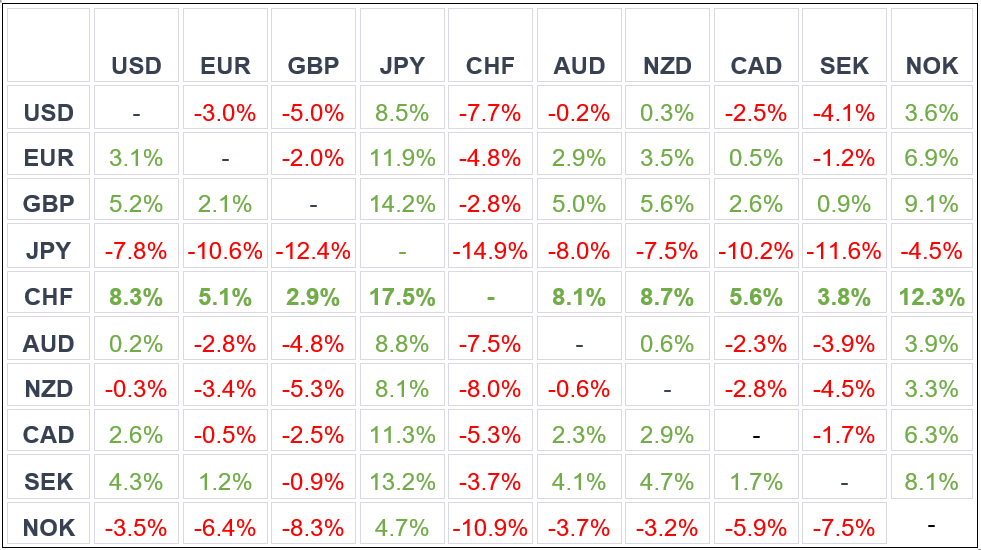

In 2023, the Swiss Franc (CHF) emerged as a dominant currency, outperforming major G-10 currencies. The numbers speak volumes: The CHF appreciated by 8.3% against the US Dollar, 5.1% against the Euro, and 2.9% against the British Pound. It surged by a remarkable 17.5% against the Japanese Yen, while also making solid gains against other currencies.

This exceptional performance is evident in the following table:

Source: Koyfin, data as of 26/12/2023

Key Factor Driving the Franc’s Strength: SNB's FX Reserve Policy

The Franc's remarkable surge in 2023 wasn't solely due to traditional interest rate dynamics. Instead, it owes much to the Swiss National Bank's (SNB) astute reserve management.

Despite lagging behind other major central banks in terms of interest rate hikes —delivering only a 75-basis-point hike in 2023 compared to the 100-basis-point increase by the Fed, 175 by the Bank of England, and 200 by the ECB— the SNB adopted a unique approach.

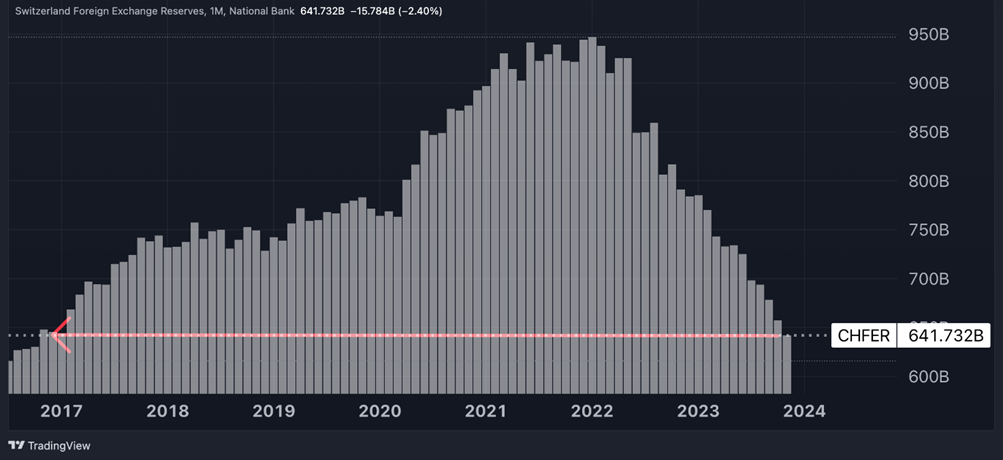

They boosted the Franc by selling foreign currency reserves, reducing these reserves from CHF 784 billion in January 2023 to CHF 641.7 billion in November 2023—a six-year low. This strategy effectively tempered inflation, mitigating the impact of volatile commodity prices and import-related inflation without resorting to rate hikes that could have harmed the Swiss economy.

As a result, Switzerland experienced a 1.3% year-on-year decline in producer prices in November 2023, marking the seventh consecutive period of decline and the sharpest drop since January 2021. Meanwhile, annual inflation slowed to 1.4% in November 2023, its lowest level since October 2021.

Chart 1: Switzerland’s FX Reserves Have Substantially Fallen Since 2022’s Peak

Policy & Economic Outlook For 2024

In its latest December's monetary policy meeting, the SNB maintained interest rates at 1.75%, aligning with market expectations. The crucial development, however, lay in the SNB's communication about its FX policy.

In their statement, the SNB surprised many by altering their FX intervention strategy, removing the previous bias towards foreign exchange selling. This shift suggests that the SNB may now consider the Swiss Franc's strength as acceptable, indicating a more balanced approach in the near future—potentially tempering its broader appreciation.

SNB's Governor, Thomas Jordan, stressed that the Swiss Franc's nominal appreciation played a vital role in containing inflation, emphasizing that current monetary conditions are conducive to maintaining inflation within the target range, thus eliminating the need for a specific FX directional bias.

While the SNB didn't strongly hint at future rate cuts, they left the door open to policy adjustments if the exchange rate becomes overly strong. Currently, money markets are pricing in approximately 20 basis points of rate cuts at the March meeting, with a cumulative easing of 64 basis points expected by September.

Looking forward to 2024, Swiss inflation is anticipated to rise, primarily in the second and third quarters, reaching a maximum of 2.0%. This uptick is attributed to factors like increasing electricity prices, rents, and VAT.

However, economic expansion is expected to remain modest in the coming quarters due to subdued international demand and stricter financial conditions. The SNB projects Swiss GDP growth to range between 0.5% and 1% in 2024.

USD/CHF Technical Analysis

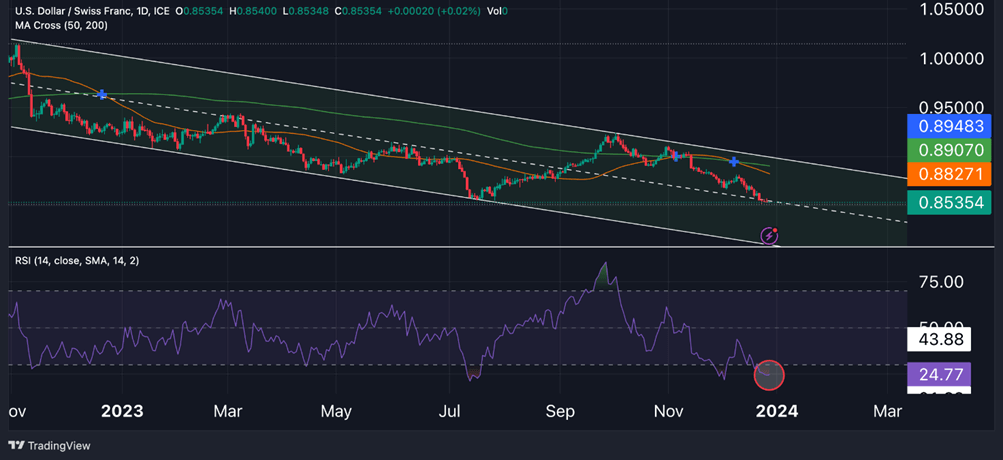

For traders eyeing the USD/CHF pair, it's worth noting that it recently hit a 9-year low at 0.85, marking a 7.6% decline since the year began. The price action has been predominantly bearish in the latter half of December, with 12 out of 14 sessions closing in the red.

Taking a closer look at the daily chart, prices are currently trading 3.3% below the 50-day moving average and 4.5% below the 200-day moving average. The relative strength index (RSI) is in oversold territory at 24, indicating a potential reversal.

Presently, the technical setup leans bearish, with an intact ascending channel dating back to October 2022. However, traders should also be aware of potential signs of bearish exhaustion, considering the rapid sell off of the dollar in recent periods.

If the pair continues its descent toward or near 0.80 by the end of the first quarter of 2024, potentially testing the lower channel line, traders might anticipate a resurgence in bullish sentiment.

In the months ahead, the direction of the USD/CHF pair is expected to be heavily influenced by the Federal Reserve's policy stance.

Should the U.S. central bank align its monetary policy with market expectations, potentially implementing 150 basis points of rate cuts in 2024, the U.S. dollar may not gain significant strength against other currencies.

Conversely, if the Federal Reserve takes a more hawkish approach and implements fewer rate cuts than anticipated, this could create opportunities for dollar bulls to regain momentum.

In conclusion, the Swiss Franc's exceptional performance in 2023 was driven by the SNB's unique reserve management strategy. As we move into 2024, the CHF's strength may continue, but it will also be influenced by global economic conditions and central bank policies.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.