Facing the dilemma of where to invest in the rapidly growing AI sector? Feel overwhelmed by the plethora of options, from giant tech conglomerates to niche AI startups?

This article hopes to offer some clarity and insight, guiding you to make informed investment decisions in this dynamic field.

Need to know

- Large, diversified tech firms that heavily use AI can offer stability for portfolios.

- Smaller, AI-focused companies present higher growth potential but with increased risk, suitable for speculative investment in AI's future.

Megacap Tech & AI

The biggest technology corporations we know (and love?) established in various tech sectors like software, search engines, social media, and hardware, are now leveraging AI to enhance their products and services. However, it's important to note that these companies are not exclusively focused on AI.

Their core business models encompass a broad range of technological solutions and services, with AI being one component of their multifaceted strategies.

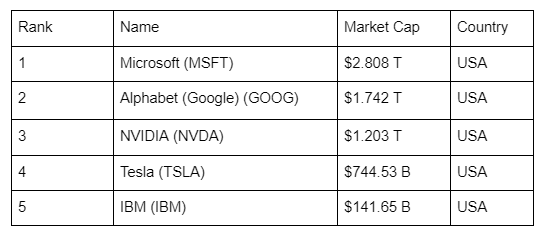

The integration of AI allows them to stay competitive, innovate, and offer improved user experiences, but it does not redefine them as solely AI businesses. If we were establishing a list of the largest stocks that heavily lean on AI, the list would be as follows:

Source: Yahoo Finance (Nov 22, 2023)

Source: Yahoo Finance (Nov 22, 2023)

From an investment perspective, holding stocks of large tech companies, such as those leading in AI, can be a crucial element of a diversified portfolio. These companies often offer stability and consistent growth due to their established market positions and diversified business models.

Top 5 AI stocks

For investors specifically aiming to speculate on cutting-edge advancements and potential breakthroughs in AI, smaller, niche companies might be more appropriate.

These smaller entities often focus exclusively on AI and related technologies, offering higher potential for growth in this specific sector. However, such investments naturally come with higher risks compared to the more established, diversified tech giants.

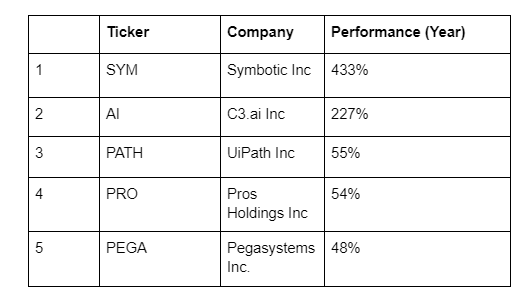

Here is a list of the best-performing AI stocks over the past 12 months

Source: Yahoo Finance (Nov 22, 2023)

Source: Yahoo Finance (Nov 22, 2023)

1. Symbotic Inc. (SYM)

As an automation technology company, Symbotic provides robotics and warehouse automation systems to retailers and wholesalers in the U.S. In 2023, the company reported a significant revenue increase to $1.18 billion, although it also reported increased losses.

Analysts currently rate SYM stock as a "Buy," but there's a forecast of a slight decrease in its stock price in the next 12 months.

2. C3.ai Inc. (AI)

C3.ai specializes in AI and machine learning applications. As of the latest data, the company has a market cap of $3.404 billion. While the PE ratio is not applicable (N/A) due to the negative earnings per share (EPS), the company has a relatively high beta, indicating greater volatility.

Its 1-year target estimate stands at 28.18.

3. UiPath Inc. (PATH)

UiPath, with a market cap of $10.38 billion, focuses on Robotic Process Automation (RPA). Despite a net income loss, the company has a forward PE of 50.74, indicating investor expectations of future profitability.

Analysts currently recommend a "Buy" with a price target suggesting a modest increase.

4. Pros Holdings Inc. (PRO)

Specializing in AI-powered pricing and revenue management software, Pros Holdings has a market cap of $1.669 billion. Similar to C3.ai, it has a N/A PE ratio and a negative EPS. The beta of 1.14 suggests moderate volatility.

The stock has a 1-year average target estimate of 42.13.

5. Pegasystems Inc. (PEGA)

Founded in 1983, Pegasystems offers customer engagement and business process management solutions. Their key product, Pega Infinity, combines business process management (BPM) with customer relationship management (CRM), targeting enterprise-size customers in the financial, insurance, and healthcare sectors.

In Summary

Each of these companies offers a unique perspective for investors, from Symbotic's focus on warehouse automation to Pegasystems' longstanding presence in BPM and CRM solutions. Their financial metrics, market positions, and sector focuses present varied investment opportunities, catering to different investor profiles and strategies.

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.