On Tuesday, the US Dollar Index has seen a slight increase, reaching $103.880, up by 0.05%, hinting at cautious optimism in the currency market.

Mercantile Exchange in Chicago | Shutterstock.com

As we step into the US trading session of March 5, 2024, the spotlight falls on key economic indicators alongside anticipated earnings reports. The agenda features major economic events releases such as the US Final Services PMI, ISM Services PMI, and Factory Orders, alongside speeches from FOMC Member Barr. These events are expected to influence market sentiment and trading strategies.

Asian & European Session's Economic Overview

As we gear up for the US trading session, the stage is set with a mix of economic indicators from around the globe, influencing NASDAQ, EUR/USD, and Gold:

Key data released include:

- New Zealand's ANZ Commodity Prices rose to 3.5%, surpassing expectations and signaling strong demand.

- Australia's current account surplus expanded significantly to 11.8B, indicating robust economic health.

- France's industrial production took a downturn, dropping by 1.1%, pointing to potential challenges in the sector.

- Service sector performance across Europe presented a mixed picture, with Spain's Services PMI standing out at 54.7, suggesting resilience amidst economic uncertainties.

- The UK's retail and service sectors showed slight deviations from expectations, with the BRC Retail Sales Monitor at 1.0% and the Final Services PMI at 53.8.

These indicators, covering commodity prices, current accounts, industrial production, and services sector health, provide a complex backdrop for the US session.

Getting Ready for US Session

- The US Final Services PMI is expected at 51.4, slightly up from the previous 51.3, highlighting the service sector's performance.

- New Zealand's GDT Price Index will provide insights into global dairy trade, with a tentative forecast of a 0.5% increase.

- A pivotal release, the US ISM Services PMI, is anticipated at 53.0, a slight decrease from 53.4, indicating service industry trends.

- Factory Orders in the US are predicted to see a significant shift, with a forecast of -3.1% after a previous increase of 0.2%.

- The RCM/TIPP Economic Optimism index is tentatively set to rise to 45.2 from 44.0, reflecting broader economic sentiments.

- FOMC Member Barr's speeches, scheduled for 17:00 and again at 20:30, will be closely watched for insights into Federal Reserve policies and economic outlooks.

In addition to macroeconomic indicators, today's session will also spotlight a series of earnings reports from notable companies. Among them are:

- CrowdStrike Holdings (CRWD): The cybersecurity firm is under the microscope with earnings per share (EPS) anticipated at $0.8233 and revenue forecasts pegging at $839.11 million. With a market cap of $75.36 billion, its performance could sway tech sector sentiment.

- Target (TGT): Retail giant Target is expected to report an EPS of $2.41 against revenue forecasts of $31.83 billion. Holding a market cap of $69.48 billion, its results could reflect consumer spending trends and impact retail sector stocks.

- Ross Stores (ROST): The off-price retailer, with a market cap of $50.49 billion, is projected to announce an EPS of $1.65 and revenues around $5.8 billion, potentially influencing retail and consumer goods sectors.

These events and reports are pivotal for shaping today's market dynamics, offering insights into economic health, consumer behavior, and corporate performance across sectors.

NASDAQ (NDX) Price Prediction: Technical Outlook

On March 5, the NASDAQ (NDX) experienced a slight downturn, closing at 16207.51, a 0.41% decrease. Positioned closely to its pivot point at $16194.31, the index is at a crossroads, suggesting potential shifts in market sentiment. Resistance levels are set at $16367.32, with further challenges at $16560.17 and $16781.39, delineating ceilings for upward movements.

Conversely, support is found at $15927.71, with additional levels at $15672.46 and $15468.26 providing a safety net against further declines.

NASDAQ Price Chart - Source: Tradingview

The Relative Strength Index (RSI) at 70 indicates that NASDAQ is nearing overbought territory, hinting at possible support around the $16,195 mark.

Despite a recent bearish engulfing candle near the 16200 level signaling potential downward momentum, the index's overall trajectory remains bullish, underscored by an upward channel on the 4-hour timeframe. However, sustaining below $16,275 could tilt the market towards bearishness, whereas surpassing this threshold may renew bullish momentum.

Trading Signal:

- Entry Price: Sell Below at $16,275

- Take Profit: $16,133

- Stop Loss: $16,400

Start Trading NASDAQ Today

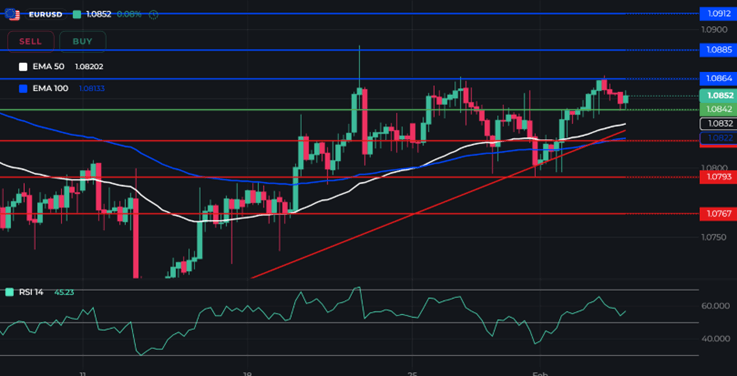

EUR/USD Price Prediction: Technical Outlook

On March 5, the EUR/USD experienced a minor decline, trading at 1.08516, a decrease of 0.04%. The pair currently hovers above the pivot point of 1.0842, indicating a potential for upward movement. Immediate resistance levels are identified at 1.0864, 1.0885, and 1.0912, potentially capping gains. Support is found at 1.0822, followed by 1.0793 and 1.0767, offering a base against downward pressure.

EUR/USD Price Chart - Source: Tradingview

The Relative Strength Index (RSI) stands at 60, suggesting a balance between buying and selling pressures. Both the 50-day and 100-day Exponential Moving Averages (1.08202 and 1.08133, respectively) signal a supportive backdrop for a buying trend.

However, a triple-top pattern on the 4-hour chart around 1.0884 hints at resistance that could curb further upside. In summary, EUR/USD's trajectory leans bullish above $1.0842, with a breach below this threshold potentially triggering a significant sell-off.

Trading Signal:

- Entry Price: Buy Limit 1.0833

- Take Profit:0867

- Stop Loss:0808

Start Trading EUR/USD Today

Gold (XAU/USD) Price Prediction: Technical Outlook

Gold (XAU/USD) experienced an uptick, climbing 0.55% to close at $2126.05. The precious metal operates above the pivotal mark of $2113.30, underscoring a potent bullish momentum. Immediate resistance lies ahead at $2142.41, with subsequent levels at $2168.94 and $2195.05 potentially challenging further advances.

Conversely, support is established at $2079.98, with deeper cushions at $2036.31 and $1989.70 safeguarding against declines. The Relative Strength Index (RSI), currently at an elevated 80, signals overbought conditions that may precede a correction. Yet, the ongoing geopolitical strains, notably the Gaza tensions, fortify gold's allure as a safe haven, sustaining its upward trajectory.

Gold (XAU/USD) Price Chart - Source: Tradingview

A bullish engulfing pattern above $2080 on the daily chart validates this surge, with the potential to approach the resistance levels specified. However, a cautious eye remains on the $2142 threshold, as a close below might trigger a pullback. In essence, Gold maintains a bullish outlook above $2115, with a descent below this juncture possibly igniting a rapid sell-off.

Trading Signal:

- Entry Price: Buy Above $2,120

- Take Profit: $2,135

- Stop Loss: $2,110

Start Trading Gold Today

Stay ahead of market movements. Subscribe for FlowBank’s daily insights and updates!

*The information contained on this page does not constitute a record of our prices, nor does it constitute an offer or solicitation for a transaction in any financial instrument. FlowBank SA accepts no responsibility for any use that may be made of these comments and for any consequences that may result therefrom. Any person who uses it does so at their own risk.