Large insurance groups are good at dealing with data to run their risk models but Insurtech can help them improve their decision-making, automation and digitalization. Here is what you need to know about insurers and tech and how the industry is changing.

Key takeaways

- Insurtech is disrupting the traditional insurance space by leverage Big Data, AI and Machine learning.

- M&A remains the core driver of insurtech investments with $9.8 billion invested in 2020.

- Large traditional insurers are acquiring insurtech groups, they offer steady share prices and large dividends.

- More public insurtech companies are hitting the market, with exciting share price prospects driven by high growth and forward looking estimates.

What is Insurtech?

Large traditional insurance groups like Allianz, AXA, and UnitedHealth Group are seeing technology companies changing the landscape. Insurance is being re-assessed by multiple disruptors, by demographic dynamics, changing risks from climate change and changing consumer habits. With a green field for insurance disruption comes many new entrants who, empowered by technology, woo customers and thus ring the bell for M&A or public listings. The most likely scenario could however be larger insurers as some analysts suggest Insurtech is shifting focus from disruption to collaboration.

The ability to leverage data is crucial in the insurance business. It enables an insurer to price risk more accurately and gain a comparative advantage over competitors. While insurance companies are not new to analyzing data and building models, two recent developments have opened the door to innovation. The first is that more data is available today and second, Big Data analytics is more important than ever to stay competitive.

Incumbent insurers need to know that 1. new entrants are specializing in certain markets and 2. that disruptors have technical abilities and flexibilities incumbents lack.

What is happening with Insurtech venture?

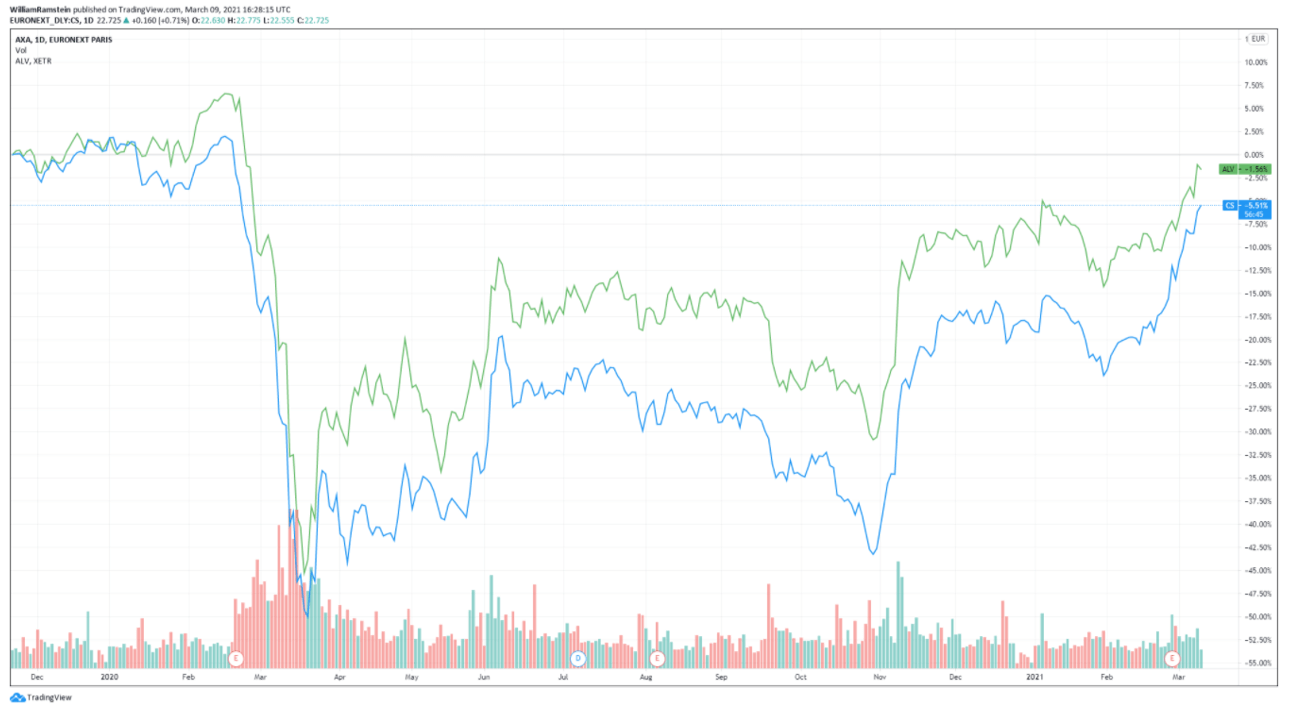

Insurtech VC deal activity has been ramping up since 2018. Last year saw 399 deals after a record 2019 saw 427 deals shown in the graph below. M&A remains the core driver of insurtech investments with $9.8 billion invested in 2020. The cumulative global deal value across VC, PE and M&A for insurtech companies was $18.3 billion in 2020 which was lower than 2019’s $19.3 billion in deals.

The insurtech ecosystem is comprised of many startups disrupting the health and life, commercial, property and casualty segments. Some notable insurtech deals include the upcoming Hippo insurance IPO, Oscar Health’s IPO last week valued at $7.9 billion, Clover Health’s IPO in January of $7 billion, Lemonade’s IPO, and Metromile’s through a SPAC deal with INSU Acquisition Corp II.

Figure 1: Insurtech VC deal activity

How do insurtech startups disrupt traditional insurance?

Insurance underwriting is expensive and highly manual suffering from data errors. Startup Cytora’s programmable insurance enables commercial insurers to integrate data and refine pricing. Policy language and coverage is error prone opening the door for startups to automate the process (see RiskGenius). Insurers sit on large datasets that could develop into valuable capabilities for customer retention (see Groundspeed). And lastly insurance securitization would allow insurers to transfer risk to capital markets by creating tradeable financial instruments with cash flows tied to premium payments (see Ledger Investing).

Insurers vs. insurtech

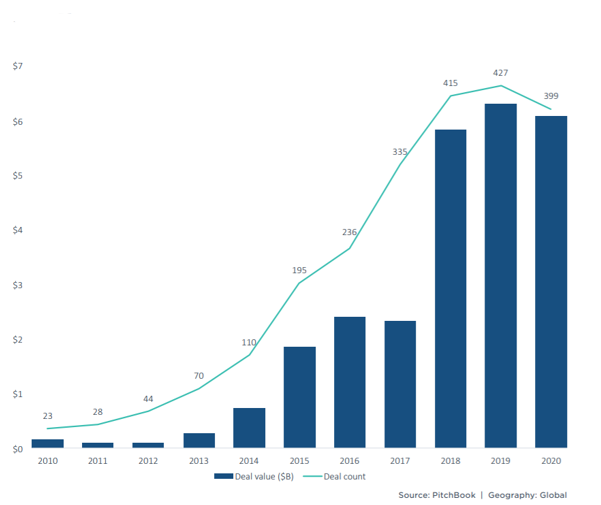

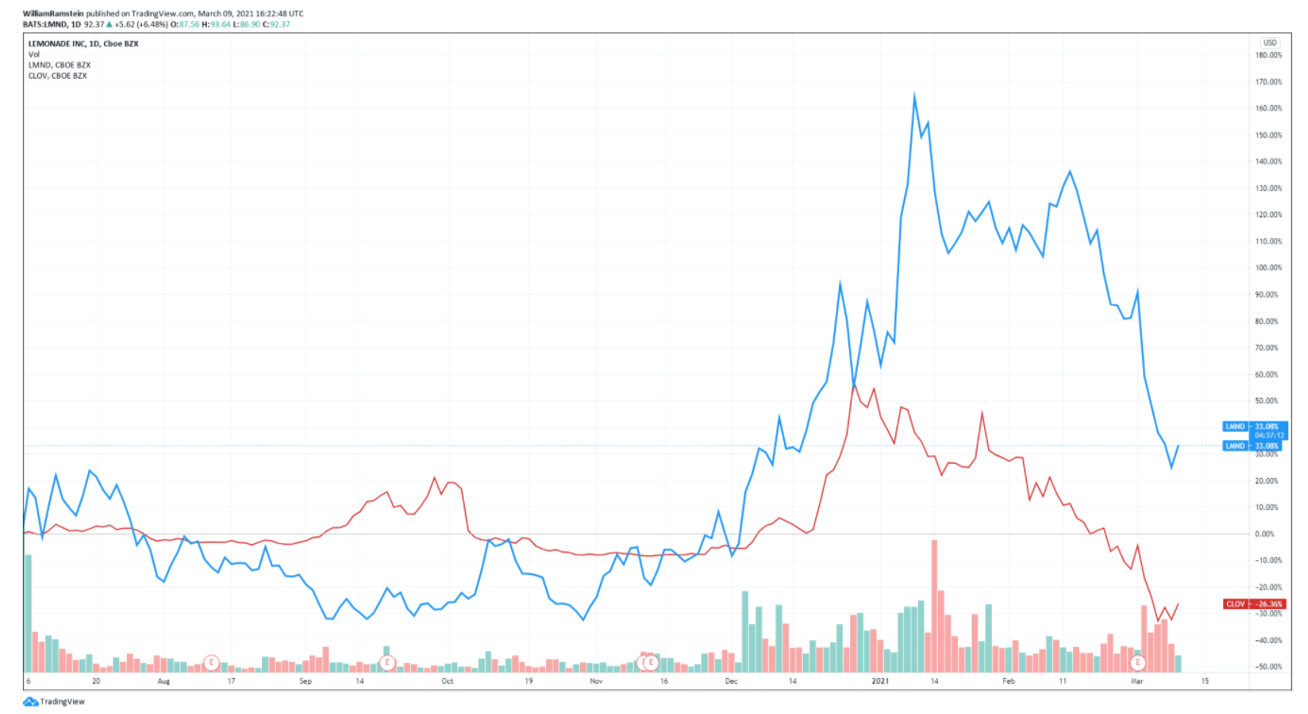

The recent tech equity selloff has affected the two insurtech companies who ever since seeing a solid start to 2021 have been falling (see figure 2). The general steadiness seen in traditional insurance stocks has matched a steadiness in profits, and also dividends, but the accelerated growth seen in insurtech firms offers more exciting share price opportunities.

Figure 2: traditional insurers in blue against insurtech in red (1 year)

What are insurance companies doing to adapt to disruption?

Maintaining a hold on market share

M&A figures demonstrate a high level of interest from insurance companies who seek to maintain market share. Beyond M&A activity, incumbents are focusing on providing targeted products, improving customer onboarding processes and deepening their relationships with existing customers. Insurers usually turn to partnerships and acquisitions and as they spend more on startups, more startups see an opportunity to be acquired leading to a cycle of increased innovation. Insurers with large balance sheets can survive black swan events and capture those startups that might not.

Tech adoption for traditional insurers

For insurers to fight against changing times, they must leave behind legacy IT models and pivot their focus from sales and marketing to digital channels supporting acquisitions. Innovation in customer acquisition, data and analytics, state of the art platforms and retaining talent will separate the weak from the strong going forward. Tech adoption has been seen on multiple fronts, with examples including Munich Re setting up Digital Partners, a specialist provider for insurtechs, Hannover Re who invested in finleap, an insurance ecosystem builder, and Swiss Re who built iptiQ, a dedicated B2B2C insurance platform.

How to play Insurtech

There are multiple ways one may capitalize on insurtech. First through insurance ETFs, then through insurers, and then through public insurtech companies.

Insurance ETFs

These three ETF offer a diversified exposure to companies involved in providing insurance policies, life insurance, and reinsurance.

KIE saw a 5-year return of 77.80% and last year, 17.64%.

KBWP saw 76% 5-year returns and 17.8% 1-year return.

IAK showed 70% over the past 5 years and 21% in 2020.

Figure 3: Insurance ETFs over the past year

Insurtech public companies

Lemonade is an American insurance company that leverages mobile, chatbots, and AI to offer renters, homeowners and pet owners insurance policies. Gross profits grew from $4.8 million in Q4 2019 to $7.5 million in Q4 2020, and gross profit margin grew from 14% in Q4 2018 to 37% in Q4 2020. They have also seen net losses of $33.9 million in Q4 2020 as operational expenses have risen.

Clover HealthClover Health sells Medicare Advantage plans focusing on customer experience and leverage machine learning to achieve better pricing outcomes. They saw 42,000 members grow to 58,000 in 2020. Revenue growth in 2020 was 46% ending the year at $673 million, but it incurred a loss of -$92 million. This loss was however an improvement from the previous year’s -$364 million. Clover’s Assistant software is what sets it apart as it provides data-based personalized insights for patients.

Figure 4: Lemonade and Clover Health stock performance

Traditional insurers stocks

AXA is the French giant of insurance offering an extremely diversified product offering. Net income fell 18% in 2020 but was positive at €3.164 billion. Revenues hit €97 billion down 1% from the previous year while the preferred segments in property, commercial and health grow 5% last quarter. Its P/E ratio is 19 times earnings offering a dividend of €1.43.

Allianz

Allianz is the German equivalent who has seen total revenues of €140.5 billion fall -1.3% from 2019. Operating profit was €10.8 billion, falling -9.3% from 2019 and the company offered a €9.60 dividend, and a P/E ratio 13 times earnings. Both companies are heavily involved in insurtech investment through their venture capital arms.

Figure 5: AXA and Allianz stock performance