Demand for ESG (Environmental, social and corporate governance) equity ETFs has climbed in 2020, particularly low-cost and broadly diversified U.S. equity products.

Below, we look at a list of broadly diversified ESG ETFs and how their sector allocation and exposure to specific holdings can influence their performance.

The story

The outbreak of Covid-19 could prove to be a major turning point for ESG investing, or strategies that consider a company’s environmental, social and governance ratings alongside traditional financial metrics.

Sustainability-focused funds attracted a record amount of capital in the first quarter of this year, even as the pandemic rattled worldwide markets. Global sustainable funds saw inflows of $45.7 billion, while the broader fund universe had an outflow of $384.7 billion, according to Morningstar.

In the U.S., sustainable funds saw a record $10.5 billion of inflows in the first quarter. About 80% of the money has gone into index funds, which means retail investors are likely behind the surge.

Chart: US active and passive funds Net flows

Indeed, ESG ETFs have gained acceptance in 2020. Many ESG equity ETFs have launched in the last five years, and this year the assets have rapidly risen off a low base. Retail - and institutional investors - have chosen relatively cheap, broadly diversified exchange-traded funds from iShares, Vanguard and a few other firms.

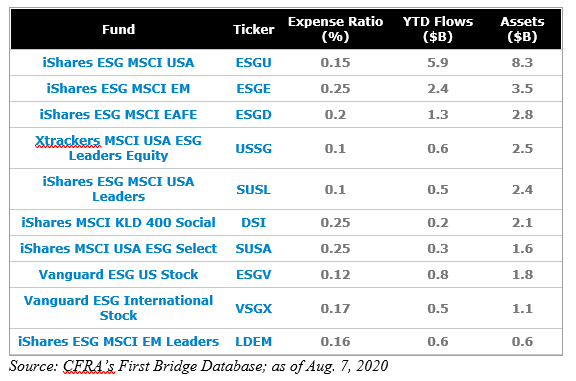

The main list is shown in the table below.

Table: A list of Broadly Diversified ESG ETFs (source: www.etf.com)

All the funds highlighted above attempt to broadly cover the three pillars of ESG with companies that meet sufficient criteria for inclusion, rather than just excluding companies that are deemed unworthy. This is different than the approaches of the SPDR S&P 500 Fossil Fuel Reserves Free ETF (SPYX) and the WisdomTree Emerging Markets ex-State-Owned Enterprises Fund (XSOE), which exclude companies based on environmental or governance characteristics.

What about performance?

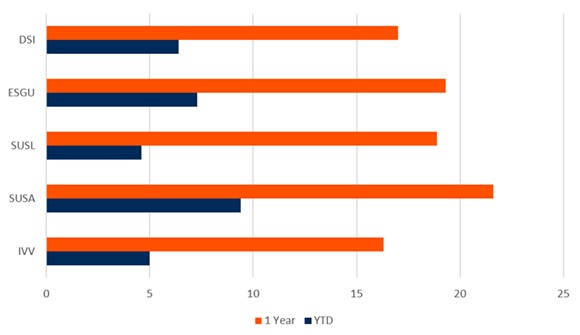

In a recent research study, www.etf.com compared the 1-year and year-to-date performance (as of 7th of August) of four iShares “core” U.S. ESG ETFs versus the IVV, a S&P 500 Index-based fund.

In 2020, SUSA, ESGU and DSI outperformed the IVV, while SUSL lagged. On a one-year basis, the 4 ETFs outperformed the S&P 500 index ETF – see chart below

Table: iShares ESG ETFs Performance Record vs. iShares S&P 500 Fund (%)

Source: CFRA’s First Bridge Database, as of Aug. 7, 2020

While the two periods under review are too short to draw any strong conclusion, what have the key drivers of outperformance?

Sector Differences

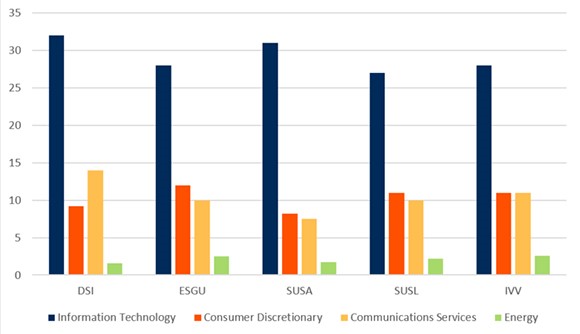

To the surprise of many, the drivers of the performance are not at the sector level. Indeed, the new breed of ESG ETFs have sector neutrality at the rebalance date and include stocks from firms with relatively high combined ESG scores compared to similar companies.

As shown on the chart below, the exposure to Technology, Consumer Discretionary, Communication Services and Energy are relatively similar at the ESG ETFs level compared to the S&P 500 ETF.

Figure: Sector Exposure of iShares ESG ETFs & S&P 500 Fund (%) – source: www.etf.com

Source: CFRA’s First Bridge Database, as of Aug. 5, 2020

As detailed in the www.etf.com study, the main difference in performance does not come from sector allocation but from the ETF holdings.

Disparities in holdings

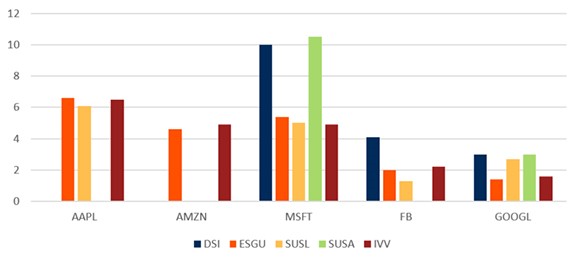

As we all know, the S&P 500 performance has been heavily impacted over the last few quarters by the 5 Mega Tech stocks, i.e Alphabet (GOOG.L) Apple (AAPL), Amazon (AMZN), Facebook (FB) and Microsoft (MSFT).

The weight of each of these Mega Tech stocks within each of these ESG ETFs does have a clear impact on performance.

While ESGU owns all five, SUSL owns just four of these growth stocks, DSI owns three and SUSA only holds two of them. The exact weight of each of them is detailed in the table below.

Figure: Stock Exposure of iShares ESG ETFs & S&P 500 Fund (%) - source: www.etf.com

Source: CFRA’s First Bridge Database, as of Aug. 5, 2020

For instance, the SUSA ETF has been the best performer on a one year and year-to-date basis. SUSA had just under 150 holdings, none of which was AAPL, AMZN or FB. However, the fund’s approximately 11% position in MSFT was nearly double the tech stock’s 5.9% weighting in IVV.

Conclusion

Investing into broadly diversified ESG ETFs requires a deeper analysis than the fund’s performance record or costs alone as sector allocation but also exposure to specific holdings can have a major effect on performance.

Read our next article: Bitcoin price moves above 12000 as hash rate reaches a new peak